Bitcoin Reaches Decisive Point Against Gold as Brandt Identifies Descending Channel

The Bitcoin-to-Gold ratio has reached a decisive juncture, as veteran market analyst Peter Brandt points out the possibility of a tradable local low.

In a recent post on X, Brandt shared a chart of the BTC/GC (Bitcoin/Gold) ratio, identifying a descending channel that could signal a reversal. This has triggered speculation across the market, as the ratio has been trending lower over the past several months.

Bitcoin Reaches Critical Juncture

Bitcoin initially outperformed gold at the start of 2024. Amid this trend, the BTC/GC ratio spiked from 20.5 at the start of the year to a peak of 34.08 on March 13. This marked a remarkable 66% increase in the price of Bitcoin against gold in the first quarter of the year.

Notably, this push was due in large part to a dramatic surge in Bitcoin’s price, which reached a new all-time high above $73K in March. For context, gold also saw an increase in Q1 2024, having risen from $2,069 at the start of the year to $2,194 in early March. However, this gradual uptick did not match Bitcoin’s rapid surge.

Interestingly, following the peak on March 13, the price of Bitcoin is now in a retracement. This correction has led to gold gaining against Bitcoin, with the BTC/GC pair forming a descending channel. The pair has been trading within this channel since mid-March, making lower highs and lower lows as it heads towards a potential breakout point.

Bitcoin critic Peter Schiff recently spotlighted this emerging trend. The lower boundary of the channel has acted as strong support, with Bitcoin bouncing from around the 23.00 level recently.

Meanwhile, the upper boundary of the channel lies around the 28.00 area, where the ratio has faced repeated resistance. Brandt’s latest comment suggests that he sees the recent bounce as a potential signal that Bitcoin could break higher against gold.

Support and Resistance Zones

The ratio is currently hovering around the 23.16 level, which has served as a pivotal support in recent months. This area has been tested multiple times, with Bitcoin repeatedly bouncing from this zone, indicating strong demand near this level.

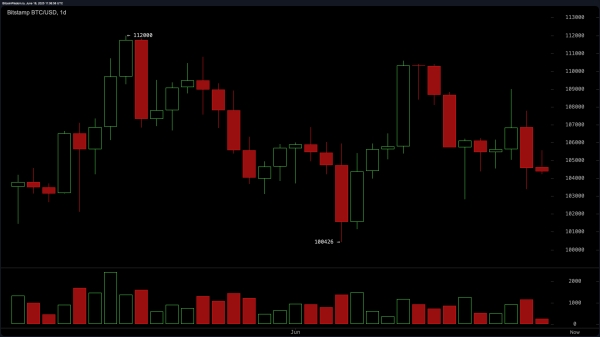

Bitcoin to Gold Ratio | Peter Brandt

Currently at 50.74, The Relative Strength Index (RSI) indicates neutrality. The RSI recently bounced from oversold levels, giving hope to bulls that the downward momentum may be slowing. Also, it is still far from overbought, leaving room for further upside if the breakout occurs.

Notably, there are several key resistance levels to watch. The most immediate is near the top of the channel, around 28.00. A breakout above this would be a bullish signal, potentially opening the door to a test of the 30.00–32.00 region, which marks a major overhead resistance.

Meanwhile, if Bitcoin fails to break above the channel and is rejected near 28.00, it could continue its downward trend within the channel. In this case, the next target would be the lower boundary of the pattern, near 21.00 or even 20.00. A breakdown below 23.16 would further confirm the bearish case.