Bitcoin’s Getting New Big Players: Fresh Whales Amassing Millions

The Bitcoin market is witnessing a significant shift as a new group of substantial investors steps onto the scene. Over the past few months, a fresh wave of high-net-worth individuals has been rapidly accumulating Bitcoin. These new “whales”—wallets holding at least 1,000 BTC that were acquired within the last six months—have collectively amassed over 1 million BTC since November 2024.

What’s particularly striking is the accelerating pace of their accumulation. This month alone, they’ve snapped up over 200,000 BTC. This significant influx of capital signals strong confidence in Bitcoin’s future and could very well be the fuel that pushes its price to new heights in the coming months.

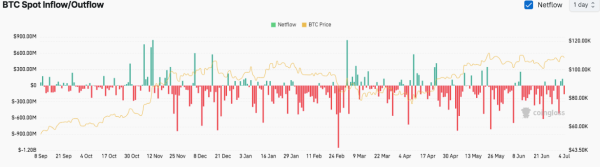

Big Buys and What They Mean for Bitcoin’s Price

According to on-chain data from CryptoQuant, this notable uptick in whale activity indicates a significant arrival of fresh capital, likely from institutional investors or very wealthy individuals.

The fact that they’ve acquired these large amounts of Bitcoin relatively recently suggests they’re entering the market at current price levels with a strong belief in its future growth potential.

Moreover, the consistent buying trend displayed by these whales could act as a key stabilizing force for Bitcoin. If this pattern continues, it could help minimize those sharp, sudden price drops we sometimes see, leading to more market stability and potentially setting the stage for record-breaking price levels.

The Surge of New Bitcoin Whales

“Since November 2024, these wallets have collectively acquired over 1 million BTC… Their accumulation pace has accelerated notably in recent weeks, accumulating more than 200,000 BTC just this month.” – By @0nchained pic.twitter.com/jVsFPjY8WA

— CryptoQuant.com (@cryptoquant_com) March 18, 2025

As of press time, Bitcoin is trading at $82,904.58, with a circulating supply of 20 million BTC and a total market capitalization of $1.63 trillion.

With this level of participation from these new big players, the possibility of Bitcoin’s price pushing beyond the $150,000 to $160,000 range looks increasingly likely, which would have a major impact on the entire market.

Technical Indicators Offer a Mixed Take

BTC/USD weekly price chart, Source: TradingView

BTC/USD weekly price chart, Source: TradingView

Despite strong accumulation trends, technical indicators suggest a mixed market outlook.

The Relative Strength Index (RSI) is currently at 46.44, having come down from overbought levels above 70. This puts Bitcoin in a neutral zone for now, meaning neither strong buying nor selling pressure is clearly dominating. However, if the RSI were to fall below 40, we might see a more significant price correction.

Adding a note of caution is the Moving Average Convergence Divergence (MACD). The MACD line has crossed below the signal line, and the negative bars on the histogram suggest some downward momentum in the short term. If this trend persists, Bitcoin could see some price dips before potentially finding support and bouncing back.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.