Bitcoin’s Low Fees Signal a Prime Time for UTXO Consolidation

Not too long ago, transaction fees on the Bitcoin blockchain stood notably higher than they do now. A low-fee window is prime for consolidating or moving UTXOs (unspent transaction outputs) to optimize costs and ready yourself for times when fees increase.

Now’s the Moment to Optimize Your Bitcoin UTXOs Before Fee Hikes

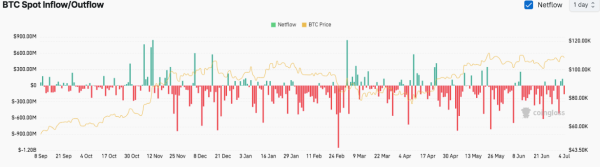

In a high-fee market, you are compelled to expend more satoshis per virtual byte (sats/vB) on transaction fees. This occurs because the Bitcoin network has finite block space, and when demand surges (for instance, during bull runs or congestion), individuals vie to get their transfers into the subsequent block.

Since Bitcoin was first conceived, miners have given precedence to transactions with steeper fee rates (calculated in sats/vB), meaning you might need to boost your fee rate if you want speedy confirmation. However, fees on the Bitcoin blockchain are currently lower than usual, and bitinfocharts.com shows that today’s average onchain fee is 0.000009 BTC or $0.875.

Mempool.space reveals a high-priority transfer fee of 2 sat/vB—equivalent to $0.27—will place a transaction in the next block. However, at 12:20 p.m. Eastern Time on Monday, seven blocks remain in queue, with about 8,495 pending transactions lingering in the mempool. The reason this is an opportune time to consolidate bitcoin is that it costs less to move coins when fees are down.

You can never predict when the next high-fee climate might strike, so it’s a proactive step unless you don’t require any consolidation. UTXO consolidation tackles high charges by cutting the number of inputs in future transactions, which directly affects the total fee. Bitcoin transaction fees hinge on a transaction’s size in virtual bytes (vBytes), and each input adds to that data load.

If you hold many small UTXOs, each one inflates the overall transaction size, leading to higher fees when sats/vB rates are elevated. By combining multiple small UTXOs into one larger unit during a low-fee period, you pay a one-time cost for that consolidation but greatly diminish the inputs required for subsequent transactions. This produces smaller transaction sizes and lower fees when sats/vB rates climb, resulting in long-term savings.

It’s a Good Time to Move Ethereum and Leverage With Decentralized Finance Protocols Too

Meanwhile, although Ethereum does not follow Bitcoin’s UTXO model and operates under a different framework, onchain fees on the Ethereum chain are also low at the moment. Bitinfocharts.com data indicates that the average ethereum fee is 0.00029 ETH or $0.765 per transfer.

At the same time, etherscan.io’s gas tracker notes a high-priority rate of 0.979 gwei or $0.07 per transaction. It costs less than two U.S. dollars to carry out tasks like listing a non-fungible token (NFT), conducting a decentralized swap, or bridging assets. As with Bitcoin, if you need to finalize any onchain objectives on Ethereum, now is an excellent time to do so.