BlackRock becomes the second-largest holder of Bitcoin globally

BlackRock becomes the second-largest holder of Bitcoin globally

![]() Cryptocurrency May 22, 2025 Share

Cryptocurrency May 22, 2025 Share

BlackRock has officially become the second-largest holder of Bitcoin (BTC) globally.

With 636,000 BTC now under management, the world’s largest asset manager sits behind only the mysterious creator of Bitcoin, Satoshi Nakamoto, who is estimated to hold 1.1 million BTC, according to new data from CryptoRank.

The milestone cements BlackRock’s dominance not just in traditional finance, but now in crypto markets as well. The firm is already the leading provider of Bitcoin ETFs by assets under management (AUM), and its inflows show no signs of slowing.

Top Bitcoin holders. Source: CryptoRank

Top Bitcoin holders. Source: CryptoRank

BlackRock’s Bitcoin spot ETF

Elsewhere, BlackRock’s Bitcoin spot ETF, iShares Bitcoin Trust (IBIT), has rapidly climbed the leaderboard and is now ranked among the top 5 U.S. ETFs by year-to-date inflows, according to the latest Bloomberg ETF flow data.

$IBIT has worked its way into the top 5 ETF in YTD flows with +$9b, just passing $BIL. This is wild bc just one month ago it was ranked 47th, but has since gone Full Pac-Man with a +$6.5b spree. As gold and cash ETFs slip down, the leaderboard is slowly turning back into 2024. pic.twitter.com/pyosSuuptU

— Eric Balchunas (@EricBalchunas) May 21, 2025

IBIT has attracted nearly $8.9 billion in net inflows, placing it ahead of long-established funds and signaling strong institutional appetite for crypto exposure.

Bitcoin ETFs overall have reached a historic milestone, with total cumulative inflows surpassing $40 billion as of May 2025. Much of that growth has come from institutional investors seeking regulated, liquid, and tax-efficient exposure to Bitcoin, particularly via spot ETFs like BlackRock’s.

For many large asset managers, pension funds, and sovereign institutions, ETFs remain the most practical or even the only route to gain exposure to Bitcoin, due to internal compliance restrictions or regulatory mandates. This trend is shifting the Bitcoin ownership structure itself: an increasing share of circulating BTC is being absorbed by ETF issuers, further centralizing holdings among a few major financial players.

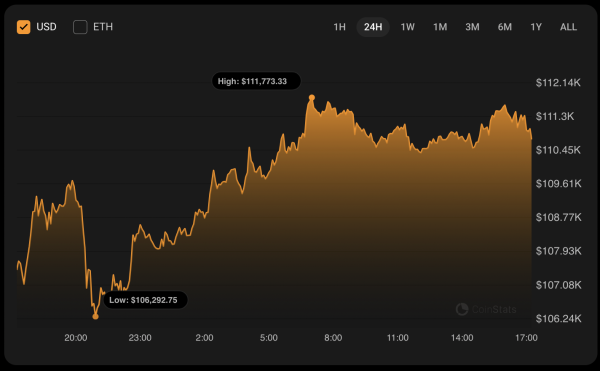

Notably, the growing institutional presence is contributing to Bitcoin’s evolving narrative from speculative asset to macro hedge and strategic reserve. With Bitcoin currently trading above $100,000, BlackRock’s position represents a powerful vote of confidence in crypto’s long-term viability.

Featured image via Shutterstock