BlackRock could dump millions of this crypto

BlackRock could dump millions of this crypto

![]() Cryptocurrency Jun 23, 2025 Share

Cryptocurrency Jun 23, 2025 Share

BlackRock’s recent crypto moves have been nothing short of aggressive, underscoring the fact that institutional adoption of digital assets is gaining full steam.

After a month-long buying spree and countless headlines featuring nine-digit acquisitions, however, the fund has finally made a major sale.

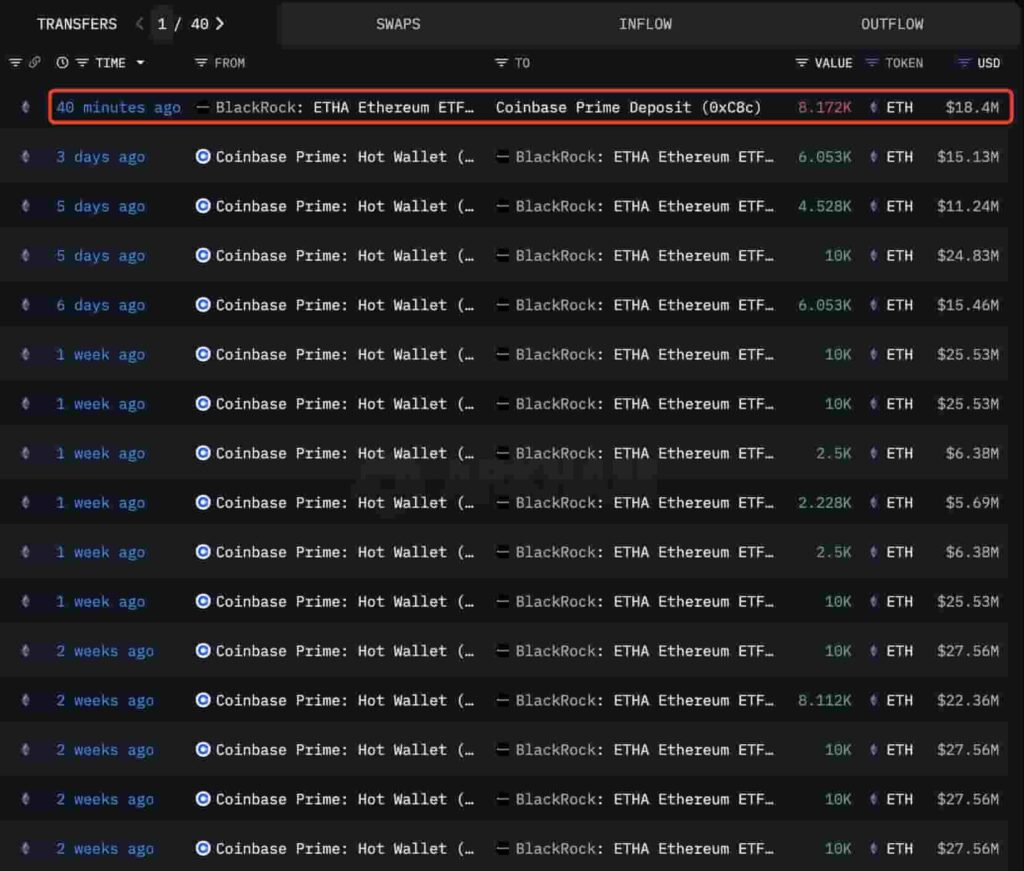

Namely, on June 23, BlackRock deposited 8,172 Ethereum (ETH), worth approximately $18.4 million, to Coinbase Prime, according to data provided by Arkham.

BlackRock ETH deposits. Source: Arkham

BlackRock ETH deposits. Source: Arkham

BlackRock ETH sale

The June 23 transaction, is seen as a potential pivot in the firm’s crypto strategy, particularly in regard to Ethereum.

However, given the fund’s past optimism and high-profile involvement in crypto ETFs (exchange-traded funds), the deposit could also reflect macroeconomic caution.

Indeed, Ethereum tanked 10% earlier today, despite $274 million in institutional inflows recorded on the weekend, trading as low as $2,178 at one point. At press time, ETH was trading at $2,257, still down -0.45%.

ETH 24-hour price chart. Source: Finbold

ETH 24-hour price chart. Source: Finbold

The primary driver behind Ethereum’s recent pullback appears to be geopolitical, as Iran has approved the plans to close the Strait of Hormuz, a vital global oil chokepoint, which could cause potential trade disruptions.

To put things into perspective, the broader crypto sector saw approximately $950 million in liquidations following the news.

Featured image via Shutterstock