Coinbase CEO Calls Bitcoin ‘The Better Form Of Money,’ Urges Governments to Hold BTC Reserves

Brian Armstrong, CEO of Coinbase, has called Bitcoin a better form of money than gold, citing its scarcity, portability, divisibility, utility, and performance.

Armstrong’s comments followed the South African Reserve Bank (SARB) Governor Lesetja Kganyago’s opposition to establishing a Strategic Bitcoin Reserve (SBR). Kganyago argued against the notion, questioning Bitcoin’s strategic value as a government-held asset.

Coinbase CEO on Bitcoin vs. Gold

In a recent post on X (formerly Twitter), Armstrong elaborated on Bitcoin’s advantages over gold.

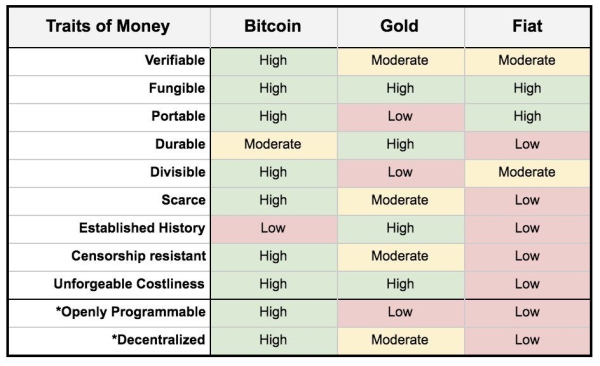

“Bitcoin is a better form of money. It has the decentralization and scarcity of gold, but better divisibility, portability, and (i think) even fungibility. It’s relatively harder to tell if gold is pure, or contains some lead in the middle of the bar,” Armstrong wrote.

Bitcoin vs. Gold Chart. Source: Brian Armstrong/X

Bitcoin vs. Gold Chart. Source: Brian Armstrong/X

He noted that Bitcoin’s market capitalization, approximately $2 trillion, represents 11% of gold’s market cap, which is around $18 trillion. The CEO expressed confidence that Bitcoin’s market cap could surpass gold within the next 5-10 years, eventually making Bitcoin reserves more significant than gold reserves.

Therefore, he argued that countries with gold reserves should consider allocating at least 11% of those reserves to Bitcoin.

“If the US leads here with a Strategic Bitcoin Reserve, I think many of the G20 will follow,” he added.

His detailed post followed the discussion at the World Economic Forum in Davos, where Kganyago expressed skepticism about governments holding Bitcoin reserves.

The SARB governor dismissed the idea of lobbying for a particular asset without strategic intent. Moreover, Kganyago emphasized gold’s historical precedence as a store of value.

“There is a history to gold, there was once a gold standard, currencies were pegged to gold. But if we now say Bitcoin, then what about platinum or coal? Why don’t we hold strategic beef reserves, or mutton reserves, or apple reserves? Why Bitcoin?,” Kganyago questioned.

He described the debate as a public policy issue that requires broader engagement, warning against industries pushing their products onto society.

In response, Armstrong highlighted Bitcoin’s track record as the best-performing asset over the last decade. He emphasized that governments should consider Bitcoin as a store of value and gradually increase their holdings over time.

“It might start with being 1% of their reserves but over time, it will come to be equal or greater than gold reserves,” Armstrong suggested.

Meanwhile, SBR continues to gain traction. States like Wyoming, Massachusetts, Oklahoma, and Texas have introduced bills to adopt Bitcoin as a strategic asset.

Furthermore, at least 15 US states, including Ohio and Pennsylvania, are actively considering measures to establish Bitcoin reserves. President Donald Trump also signed an executive order to create a “national digital asset stockpile.” This move has paved the way for a more formalized approach to integrating digital assets into the country’s financial strategy.