Crypto faces largest downtrend of cycle, says Glassnode

As crypto markets face their biggest downturn of the cycle, long-term investors are increasingly holding onto their assets, analysts say.

Bitcoin (BTC) is grappling with the most significant downtrend of the current cycle, but recent data suggests a shift towards a more patient and resilient investor base. According to a Glassnode report on Aug. 13, the market is experiencing its “largest downtrend of the cycle,” following an extended period of aggressive distribution by investors.

Despite the challenging conditions, there’s a growing trend among long-term holders to retain their assets rather than sell, signaling a shift in investor behavior toward “hodling.”

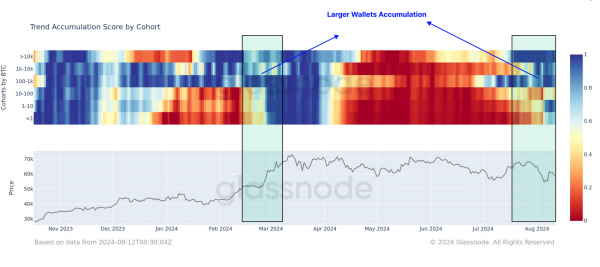

Bitcoin’s trend accumulation score by cohort | Source: Glassnode

Bitcoin’s trend accumulation score by cohort | Source: Glassnode

The Accumulation Trend Score, which measures market-wide accumulation patterns, has reached its highest possible value of 1.0, indicating a return to accumulation. Glassnode reports that this cohort has now “returned to a preference for HODLing, with a total volume of +374,000 BTC migrating into LTH status over the last three months.”

You might also like: Bitcoin’s rally might be setting up for a sudden drop

Bitcoin’s price holds strong despite sell-offs

Despite aggressive sell-offs from April to July, Bitcoin’s spot price has remained above the Active Investor Cost Basis, indicating continued market strength, according to the blockchain research firm.

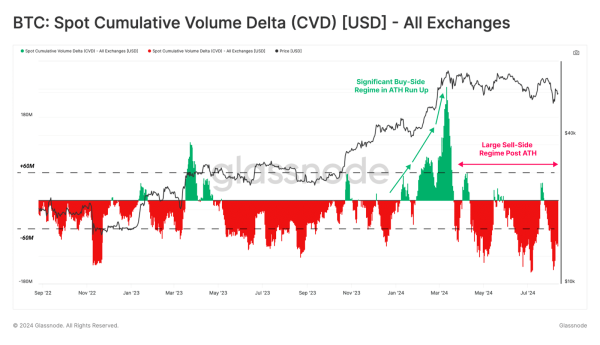

Bitcoin’s spot CVD metric | Source: Glassnode

Bitcoin’s spot CVD metric | Source: Glassnode

The report also highlights that the adjusted Spot Cumulative Volume Delta metric has been negative, reflecting persistent net sell-side pressure. Nonetheless, the LTH Sell-Side Risk ratio remains at a “lower level” compared to prior all-time high breaks, implying that the magnitude of profit taken by the LTH cohort is “comparatively small relative to previous market cycles,” Glassnode says.

“This also infers that this cohort is waiting for higher prices before ramping up their distribution pressure,” the firm added.

With Bitcoin’s price hovering around $60,000, investors appear to be waiting for “higher prices” before adjusting their holdings, Glassnode summarized, suggesting a patient, long-term outlook despite the ongoing spark of volatility.

Read more: Bitcoin could see short-term price surge amid increased whale activity

Source