Crypto markets set Bitcoin’s next record high after BTC clinches $123,000 ATH

Crypto markets set Bitcoin’s next record high after BTC clinches $123,000 ATH

![]() Cryptocurrency Jul 14, 2025 Share

Cryptocurrency Jul 14, 2025 Share

Sentiments across the cryptocurrency market remain elevated on the bullish side after Bitcoin (BTC) reached an all-time high of over $123,000.

To this end, prediction markets are suggesting that the maiden cryptocurrency is likely to see more upside in the coming months.

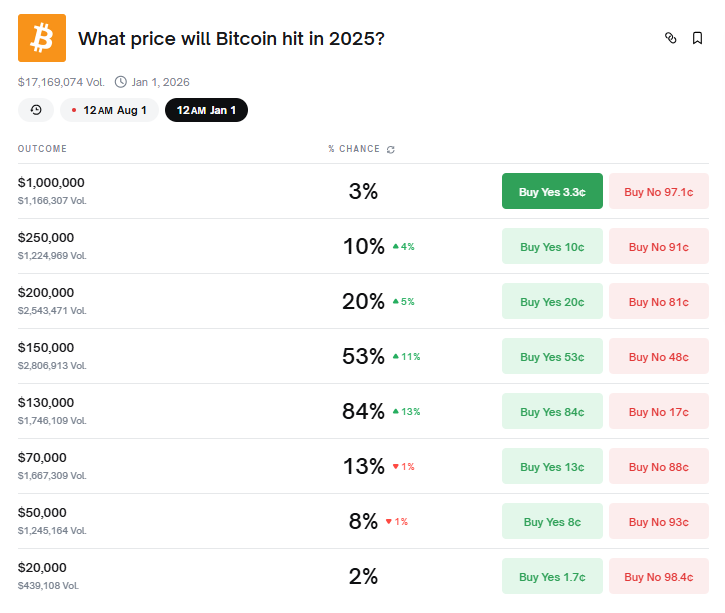

Specifically, traders on cryptocurrency betting platform Polymarket see an 84% chance that BTC will reach at least $130,000, the highest-probability outcome, according to the latest data retrieved by Finbold on July 13.

The next most likely level is $150,000, with a 53% chance. Beyond that, optimism wanes but remains notable, with a 20% probability that Bitcoin will reach $200,000 and a 10% chance of surpassing $250,000.

At the extreme end, the platform assigns a 3% chance that Bitcoin will reach $1 million by 2025.

Bitcoin price prediction for end of 2025. Source: Polymarket

Bitcoin price prediction for end of 2025. Source: Polymarket

Meanwhile, some traders are hedging for a potential correction, as lower price targets like $70,000 (13%), $50,000 (8%), and $20,000 (2%) remain on the board, though each has seen a slight decline in likelihood in the aftermath of Bitcoin’s new record high.

Why Bitcoin is breaking out

It’s worth noting that several factors drove the Bitcoin and broader cryptocurrency market rally. The asset’s valuation received a major boost following continued institutional inflows after Japan’s Metaplanet snapped up 797 BTC worth $93.6 million on July 14, as part of its plan to hold 1% of Bitcoin’s total supply by 2027.

🇯🇵JUST IN: Metaplanet acquires 797 more $BTC, bringing total holdings to 16,352 BTC.

One of Asia’s boldest Bitcoin balance sheets just got bigger. 💪 pic.twitter.com/SjIiyhEqvL

— CryptosRus (@CryptosR_Us) July 14, 2025

Meanwhile, spot Bitcoin ETFs recorded $1.3 billion in net inflows over the week, led by BlackRock’s, which now holds 700,000 BTC, pushing demand to nearly 20 times the amount of Bitcoin mined daily.

Finally, macroeconomic trends have added momentum to Bitcoin’s ongoing rally. Investors are turning to the asset amid a weakening U.S. dollar, which has declined by 11% over the past six months, and renewed geopolitical tensions triggered by President Donald Trump’s tariffs and sanctions threats. These factors have seen investors view Bitcoin as a potential safe-haven asset.

Bitcoin price analysis

At the time of reporting, Bitcoin was valued at $122,165, having rallied 3.6% in the last 24 hours. On the weekly timeline, the asset is up 12%.

Bitcoin seven-day price chart. Source: Finbold

Bitcoin seven-day price chart. Source: Finbold

While bullish sentiment around Bitcoin appears to be prevailing, investors and traders should be mindful of signs of exhaustion in the asset.

On this note, the 14-day relative strength index (RSI) stands at 74, entering the overbought zone and signaling a possible retracement in valuation or consolidation.

Featured image via Shutterstock