Donald Trump’s crypto launch faces issues on day one — What’s happening?

Donald Trump’s crypto launch faces issues on day one — What’s happening?

![]() Cryptocurrency Oct 15, 2024 Share

Cryptocurrency Oct 15, 2024 Share

Donald Trump’s highly anticipated entry into the cryptocurrency space through the World Liberty Financial (WLFI) token had a rocky start on October 15.

Despite extensive promotion by Trump and his family, the project encountered significant hurdles during its public token sale.

Technical challenges overshadow the token launch

World Liberty Financial kicked off the token launch with a broadcast on X Spaces, although Donald Trump himself was absent from the event. Within the first hour of WLFI going live, users reported over $5 million in sales.

Picks for you

R. Kiyosaki advises how to 'survive and thrive' in US high inflation 9 hours ago Sui ‘infrastructure partner’ to dump $20 million more amid selling spree 9 hours ago MicroStrategy outpaces S&P 500 and tech giants with Bitcoin strategy 10 hours ago dYdX announces Donald Trump Prediction Market perpetuals 11 hours ago

Trump's token @worldlibertyfi started their presale, raised $5M and the site has been offline for like 2-3 hours apparently, didn't prepare for the heavy load? pic.twitter.com/cx3eVOsi19

— Wazz (@WazzCrypto) October 15, 2024

However, the project’s website crashed during this period, causing major disruptions to continuous sales. Transaction data confirmed that technical issues, including frequent site outages, hampered the token sale.

Lower-than-expected sales

The sale was designed to raise $300 million by offering WLFI tokens to over 100,000 accredited U.S. investors, all of whom were whitelisted for early access. Unfortunately, due to the website crashes and other technical difficulties, the sales process slowed significantly, resulting in far lower-than-expected participation.

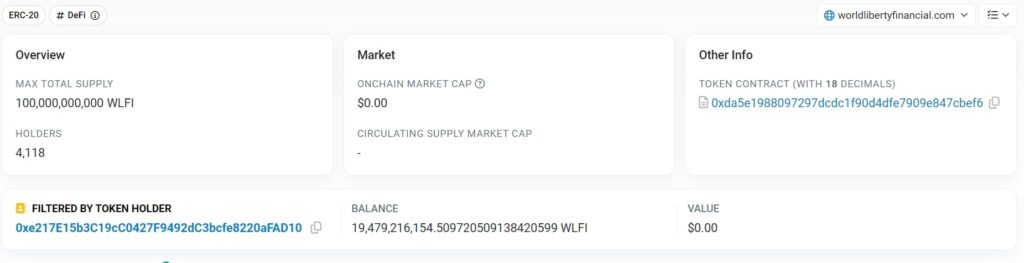

Number of holders of WLFI token in the initial sale. Source: Etherscan

Number of holders of WLFI token in the initial sale. Source: Etherscan

At the time of writing, Etherscan data shows that just over 4,118 participants acquired WLFI tokens in the initial sale despite a large number of whitelisted investors. Out of the 100 billion WLFI tokens available, 35 billion were allocated for this round, but the majority of tokens remained unsold.

The Ethereum wallet managing the token sale holds over $5 million in assets, including Ether (ETH), Tether (USDT), and USD Coin (USDC), but this fell short of the project’s $300 million target.

Election influence and potential Bitcoin correlation

Donald Trump, serving as the “Chief Crypto Advocate” for the project, has tied his political brand to the cryptocurrency space.

His sons, Eric, Donald Jr., and Barron, are also involved in the project as Web3 ambassadors. World Liberty Financial aims to bring Web3 technology into the mainstream, promoting decentralized finance (DeFi) activities such as borrowing, lending, and liquidity pooling through its platform.

Despite the high-profile endorsements, the technical issues during the token launch, combined with Trump’s absence from the event, raised skepticism among investors. Many are now questioning the project’s potential for success.

However, Trump’s rising political momentum could play a role in boosting interest in WLFI.

A comparison of Trump’s betting odds to win the upcoming election against Vice President Kamala Harris shows that Trump’s chances have increased, reaching 53% as of October 10.

This political rise could draw more attention to World Liberty Financial, especially as his association with cryptocurrency might influence Bitcoin’s price trajectory as well.

Uncertain future for WLFI

The project’s long-term vision involves using the WLFI token for governance and platform upgrades, allowing token holders to vote on important decisions such as protocol upgrades, partnerships, and risk management strategies.

However, these governance features will only be accessible once the platform is fully operational, as reported by the Block

For now, World Liberty Financial faces the immediate challenge of regaining investor confidence following its troubled launch. Whether Trump’s political influence and the project’s DeFi ambitions can overcome the rocky start remains to be seen.