Ethereum or Avalanche? We asked ChatGPT-4o which crypto is a better buy for 2024

Ethereum or Avalanche? We asked ChatGPT-4o which crypto is a better buy for 2024

![]() Cryptocurrency Jul 31, 2024 Share

Cryptocurrency Jul 31, 2024 Share

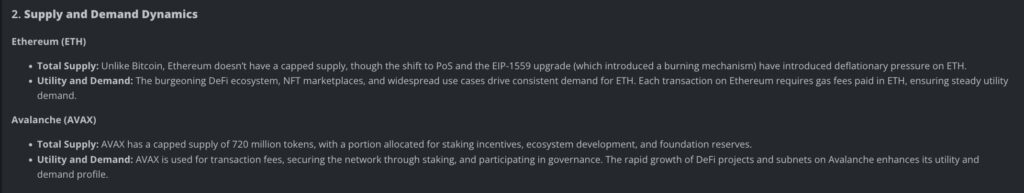

On July 31, Finbold turned to OpenAI‘s ChatGPT-4o to determine the best cryptocurrency investment for the 2024 bull market cycle. The artificial intelligence (AI) model compared Ethereum (ETH) and Avalanche (AVAX), considering their current market positions and potential for growth.

Surprisingly, ChatGPT-4o leaned towards Avalanche as the potentially more lucrative investment, citing its lower market cap and rapid ecosystem expansion as key factors.

At the time of the analysis, Ethereum traded at $3,300 with a market cap of nearly $400 billion, while Avalanche stood at $26.60 with a $10.5 billion market cap. The AI examined various aspects, including fundamentals, supply and demand dynamics, ecosystem growth, and market sentiment to reach its conclusion.

Picks for you

2 cryptocurrencies to reach $5 billion market cap in August 3 hours ago Here's how gold will kickstart Bitcoin's bull run, according to analyst 4 hours ago $400 million Bitcoin trader signals price optimism with massive BTC buy 8 hours ago Analyst eyes XRP price at $0.90 by year-end if it breaks this pattern 8 hours ago

Ethereum vs. Avalanche: Fundamentals and ecosystem growth

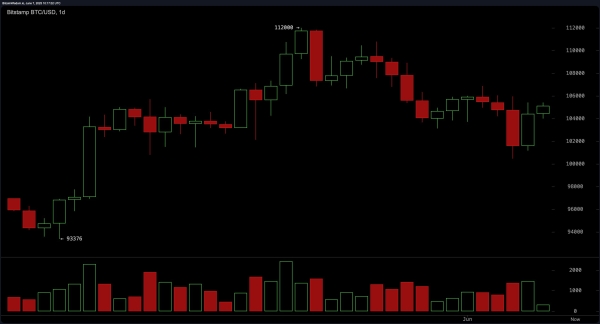

ChatGPT-4o acknowledged Ethereum’s status as the pioneer of smart contracts and its vast Web3 ecosystem. Moreover, it highlighted Ethereum’s transition to proof-of-stake and its large developer community as significant advantages. However, the AI also emphasized Avalanche’s impressive speed, scalability, and innovative consensus mechanism.

ChatGPT-4o: Ethereum vs. Avalanche – Fundamentals. Source: NanoGPT / Finbold

ChatGPT-4o: Ethereum vs. Avalanche – Fundamentals. Source: NanoGPT / Finbold

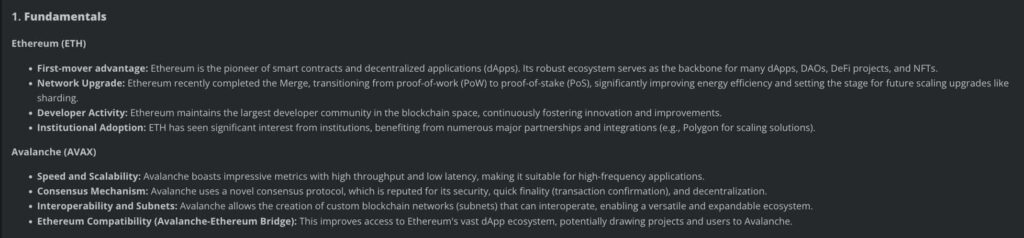

Furthermore, ChatGPT-4o noted Ethereum’s dominance in decentralized finance (DeFi) and non-fungible tokens (NFTs), along with its growing layer-two solutions. Meanwhile, it praised Avalanche’s rapidly expanding ecosystem, particularly in areas like GameFi and NFTs. The AI also pointed out Avalanche’s unique subnet feature, which allows for customizable blockchain networks.

ChatGPT-4o: Ethereum vs. Avalanche – Ecosystem Growth. Source: NanoGPT / Finbold

ChatGPT-4o: Ethereum vs. Avalanche – Ecosystem Growth. Source: NanoGPT / Finbold

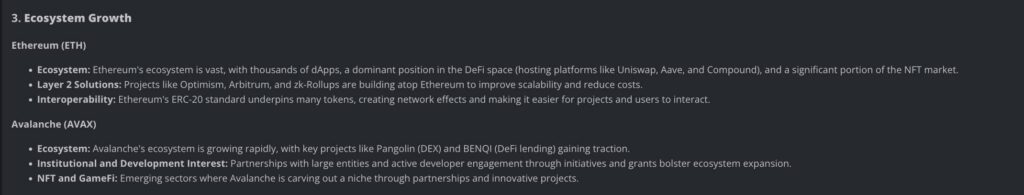

When analyzing supply and demand dynamics, ChatGPT-4o highlighted Ethereum’s deflationary pressure due to recent upgrades. It also noted the consistent demand for ETH driven by its utility in the DeFi ecosystem. For Avalanche, the AI emphasized its capped supply of 720 million tokens and growing utility.

ChatGPT-4o: Ethereum vs. Avalanche – Supply Dynamics. Source: NanoGPT / Finbold

ChatGPT-4o: Ethereum vs. Avalanche – Supply Dynamics. Source: NanoGPT / Finbold

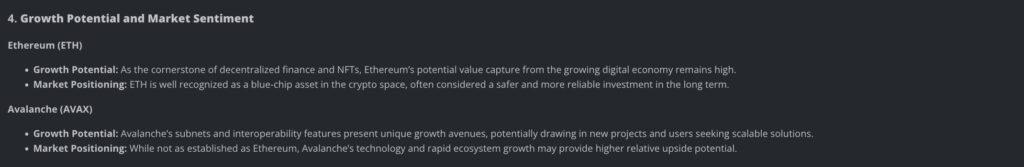

Regarding market sentiment and growth potential, ChatGPT-4o recognized Ethereum as a blue-chip asset with a strong market position. Nevertheless, it suggested that AVAX’s lower market cap could provide higher relative upside potential, especially given its technological advantages and rapid ecosystem growth.

ChatGPT-4o: Ethereum vs. Avalanche – Growth Potential. Source: NanoGPT / Finbold

ChatGPT-4o: Ethereum vs. Avalanche – Growth Potential. Source: NanoGPT / Finbold

ETH or AVAX?

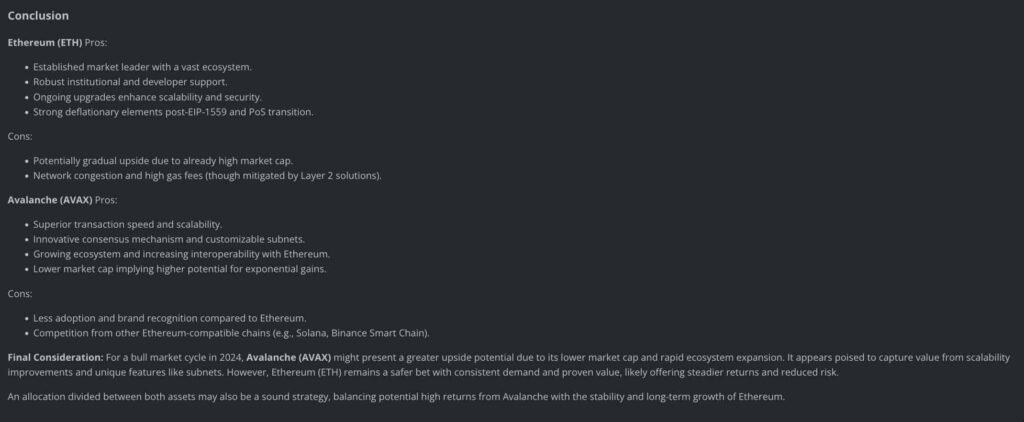

In conclusion, ChatGPT-4o recommended Avalanche as the potentially more lucrative investment for the 2024 bull market cycle. The AI cited AVAX’s lower market cap, rapid ecosystem expansion, and unique features like subnets as key factors supporting this decision.

Yet, it also acknowledged Ethereum’s strengths and suggested that a balanced allocation between both assets could be a sound strategy.

ChatGPT-4o: Ethereum vs. Avalanche – Conclusion. Source: NanoGPT / Finbold

ChatGPT-4o: Ethereum vs. Avalanche – Conclusion. Source: NanoGPT / Finbold

Ultimately, while ChatGPT-4o’s analysis provides valuable insights, investors should conduct their own research and consider their risk tolerance before making investment decisions. The cryptocurrency market remains highly volatile, and past performance does not guarantee future results.

As always, diversification and careful consideration of one’s financial goals are crucial in navigating the exciting yet unpredictable world of cryptocurrency investments.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.