Ethereum selling spree ‘almost over’ with 80% ETH outflow drop

Ethereum selling spree ‘almost over’ with 80% ETH outflow drop

![]() Cryptocurrency Aug 3, 2024 Share

Cryptocurrency Aug 3, 2024 Share

Ethereum (ETH) price is down nearly 15% since the exchange-traded funds (ETFs) first trading day on July 23. Grayscale’s Trust (ETHE) registered over $2 billion in outflows, creating a relevant selling pressure that could now be “almost over.”

Notably, Grayscale, a leading cryptocurrency asset manager, currently offers two Ethereum spot ETFs: ETHE and the Mini Trust (ETH). The former, however, is being heavily sold due to its higher fees in comparison to the growing competitors.

However, Arkham Intelligence reported a massive 80% drop in ETHE outflows during the week, suggesting “the selling is almost over.” The report shows a 108,800 ETH outflow on Monday against a 24,900 ETH outflow on Friday.

Picks for you

Bitcoin short-term targets hit as recession fears loom; Analysts see opportunity 46 mins ago Robert Kiyosaki shares the 'great news' from the crashing stock market 3 hours ago Analyst sets timeline for Bitcoin's 'capitulation event' that’s due next 5 hours ago ChatGPT-4o predicts Cardano (ADA) price for August 31, 2024 21 hours ago

GRAYSCALE ETHE OUTFLOWS DOWN ~80% THIS WEEK

Grayscale ETHE outflows this week are down almost 80%.

Monday: 108.8K ETH ($367.6M) sent to Coinbase

Friday: 24.9K ETH ($78.4M) sent to CoinbaseIs the selling almost over? 👀 pic.twitter.com/QfooUqtjqo

— Arkham (@ArkhamIntel) August 3, 2024

Ethereum spot ETF net flow

Finbold retrieved data from CoinGlass on August 3, highlighting the flow of all ETH ETFs trading in the United States. Overall, Grayscale’s ETHE registered $2.12 billion outflows, while the other eight trusts had $1.60 billion inflows.

BlackRock’s (NYSE: BLK) iShare Ethereum Trust (ETHA) leads the pack with over $700 million net inflow. It is followed by Fidelity (FETH) and Bitwise (ETHW) with $297.10 million and $287.90 million, respectively.

Such a massive selling spree from Grayscale has resulted in a negative net inflow of $511.20 million despite all the other funds being heavily buying Ethereum’s native token.

Total Ethereum Spot ETF Net Inflow USD. Source: CoinGlass

Total Ethereum Spot ETF Net Inflow USD. Source: CoinGlass

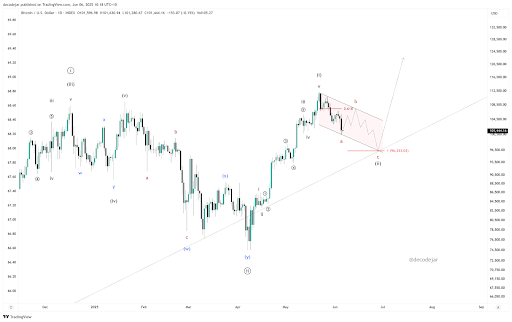

Ethereum (ETH) price analysis

As of this writing, ETH trades at $2,986, testing strong yearly support while still up 31% year-to-date. This impressive performance has attracted institutional and retail investors to the Ethereum ecosystem, now waiting for a breakout upwards.

Ethereum (ETH) year-to-date price chart. Source: Finbold

Ethereum (ETH) year-to-date price chart. Source: Finbold

Whether ETH will manage to bounce back from support or not will depend on the micro and macroeconomics surrounding cryptocurrencies. Interestingly, winning Ethereum traders have been showing optimism, accumulating millions of dollars of the token, as reported by Finbold.

Grayscale’s selling spree could have significantly impacted this cryptocurrency’s price. Therefore, this pressure coming to an end could work favorably for Ethereum, possibly triggering the so-awaited bull run.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.