Ethereum’s relationship with the S&P 500 hints ETH to hit $10,000

Ethereum’s relationship with the S&P 500 hints ETH to hit $10,000

![]() Cryptocurrency Nov 5, 2024 Share

Cryptocurrency Nov 5, 2024 Share

Ethereum (ETH) has established a relationship with the S&P 500 index, a correlation that points to a record-high price target for the second-ranked cryptocurrency by market capitalization.

In this case, Ethereum might be poised for a record high of $10,000 in a manner that replicates the recent rally by the index, cryptocurrency trading expert Ali Martinez observed in an X post on November 5.

S&P 500 and Ethereum correlation chart. Source: TradingView/Ali_charts

S&P 500 and Ethereum correlation chart. Source: TradingView/Ali_charts

According to the analysis, both asset classes have experienced a strong recovery after the 2022 market dip, establishing higher lows and climbing steadily.

Picks for you

Pnut (PNUT) crypto token soars over 100% ahead of U.S. election 27 mins ago Here’s how the market is pricing the US presidential elections today 31 mins ago Bitcoin recovers after Mt. Gox-related panic selling on Monday — What’s next? 3 hours ago XRP or Stellar (XLM)? We asked ChatGPT-4o which crypto is a better buy for 2025 4 hours ago

Ethereum’s support level around the $2,600 mark aligns with the support seen in the S&P 500. This similarity could suggest a path for Ethereum to follow if the S&P 500’s momentum continues.

With Ethereum recently witnessing some volatility, Martinez noted that this “could be the last dip before Ethereum triples,” projecting a price target of $10,000.

Ethereum’s bearish case

While ETH’s correlation with the index signals a possible rally, the asset’s price movement compared to Bitcoin (BTC) shows worrying signs. Following Ehereum’s recent correction below the $2,500 support zone, ETH has declined to its lowest valuation relative to Bitcoin since April 2021.

BTC/ETH price chart. Source: Barchart

BTC/ETH price chart. Source: Barchart

The decline is part of a broader trend in which Ethereum has consistently underperformed against Bitcoin since mid-2022. Indeed, this performance saw Ethereum come under scrutiny after failing to mimic Bitcoin in hitting new highs.

To this end, concerns have emerged regarding Ethereum’s long-term sustainability. For instance, in an X post in late October, Cyber Capital’s founder and CIO, Justin Bons, alleged that “no hope left for ETH anymore,” citing concerns regarding the network’s Layer 2 venture funding and token dynamics.

1/9) Ethereum is cooked

Corrupted by L2 VC funding & tokens, nobody is scaling ETH's L1 anymore; they will not allow it!

That is why there is no hope left for ETH anymore

Following the bitcoiners into irrelevance with quasi-religious word salads justifying their mediocrity: 🧵

— Justin Bons (@Justin_Bons) October 28, 2024

At the same time, long-term investors have shown waning interest in Ethereum.

With Ethereum witnessing short-term correction, on-chain data suggested that the decentralized finance (DeFi) asset might witness more corrections in the coming days.

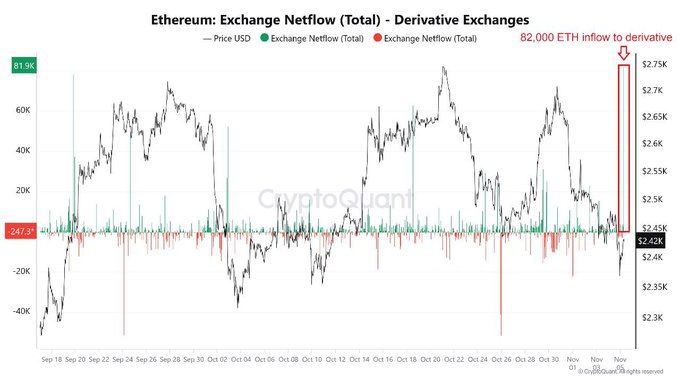

Data shared by a technical analyst with the pseudonym Kyledoops in an X post on November 5 noted that there has been a massive inflow of 82,000 ETH into derivative exchanges.

Ethereum exchange netflow and derivative exchanges. Source: CryptoQuant

Ethereum exchange netflow and derivative exchanges. Source: CryptoQuant

Based on historical patterns, such movements have served as a precursor to sharp price corrections or increased volatility.

The influx may suggest that traders position themselves for aggressive market moves, possibly hedging against anticipated downturns or gearing up for rapid fluctuations.

Elsewhere, investors are demonstrating bullish sentiments, as evidenced by a whale with a 100% trading win rate who acquired $18.8 million worth of ETH.

Ethereum price analysis

Ethereum was trading at $2,442 by press time, dropping 1.25% in the last 24 hours. On the weekly chart, ETH has fallen over 6%.

ETH seven-day price chart. Source: CoinMarketCap

ETH seven-day price chart. Source: CoinMarketCap

As things stand, the asset’s technical setup shows signs of extended bearishness in the near and long term. In this regard, ETH is trading below the 50-day and 200-day moving averages, as breaching the $2,500 mark remains the key area to watch.

The trajectory of this price movement will likely be influenced in the next 24 hours, depending on how the market price in the results of the U.S. presidential elections.

Overall, Ethereum’s long-term prospects remain mixed, with an artificial intelligence tool predicting that the asset might trade between $1,800 and $4,000 by the end of 2024.