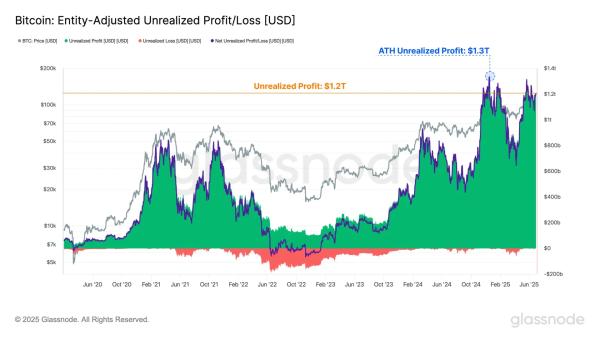

Glassnode Analyst Explained: “Bitcoin Rally Will Continue Only If This Level Is Exceeded, Otherwise It Will Be A Dream!”

While the leading cryptocurrency Bitcoin (BTC) has been on the rise in recent days after the sharp declines it experienced, investors continue to be cautious.

While the rise in BTC could not fully convince investors, Glassnode analyst explained the critical level that must be passed for the rally to begin.

Glassnode analyst CryptoVizArt said that the BTC price needs to break the $90,000-$93,000 barrier to reach new highs.

Stating that the average cost base of the majority of recent Bitcoin buyers is between $90,000 and $93,000, the analyst noted that the Bitcoin price may face selling pressure here.

Stating that selling pressure could come from investors who are targeting their positions without making a loss, the analyst argued that a new ATH will not occur unless the $90,000-$93,000 range is successfully overcome.

“The cost basis of the latest investors who bought during the euphoria from November 2024 to February 2025 is between $90,000 and $93,000.

Any jump into this area is likely to encounter selling pressure from those aiming to exit without losing money.

But without regaining this supply zone, a new ATH remains a pipe dream.”

Keith Alan, co-founder of trading platform Material Indicators, also shared a similar analysis to the Glassnode analyst, who said that Bitcoin needs to reclaim its yearly opening of $93,300 in 2025 to reach the new ATH.

Finally, Glassnode wrote in its weekly report that, according to on-chain data, the cost price of short-term investors (STH) is at $93,500. According to Glassnode, as long as this level is not regained in Bitcoin, it will not be possible to talk about a real bull momentum.

*This is not investment advice.