Here’s how much an early 2025 investment in Anthony Scaramucci’s crypto portfolio would be worth today

Here’s how much an early 2025 investment in Anthony Scaramucci’s crypto portfolio would be worth today

![]() Cryptocurrency Mar 6, 2025 Share

Cryptocurrency Mar 6, 2025 Share

Anthony Scaramucci, founder of SkyBridge Capital and former White House Communications Director, remains one of Bitcoin’s (BTC) most outspoken advocates.

While Bitcoin remains Scaramucci’s largest holding, with over 50% of his portfolio allocated to BTC, he has also invested in Solana (SOL), Avalanche (AVAX), and Polkadot (DOT)—assets chosen primarily for their utility.

Speaking on the Bankless podcast in early January, Scaramucci highlighted Solana as his top choice among layer-one blockchains, citing its speed and low transaction costs as key advantages.

Picks for you

Is the S&P 500 about to surge by 20%? 2 hours ago What’s going on with the Euro vs. Dollar (EUR/USD)? 3 hours ago Cardano’s Charles Hoskinson names 4 ‘domain experts’ to Trump’s Crypto Summit 3 hours ago Top 5 Commodities to buy in 2025 4 hours ago

His outlook on Bitcoin remains equally optimistic, having predicted last year that BTC would surpass $100,000 in 2024, fueled by surging demand for Bitcoin exchange-traded funds (ETFs).

Looking ahead, he believes pro-crypto policies under a new administration could drive Bitcoin’s value even higher, potentially doubling by 2025.

However, despite his optimism for digital assets, he warns that Donald Trump’s protectionist trade policies, particularly a blanket tariff approach, could introduce economic headwinds, potentially pushing the U.S. into a recession—a factor that has weighed heavily on market sentiment.

Anthony Scaramucci’s portfolio performance in 2025

For investors who mirrored Anthony Scaramucci’s crypto portfolio with a $1,000 investment made on January 1, 2025, the results have been rough, with all his favored assets deep in the red.

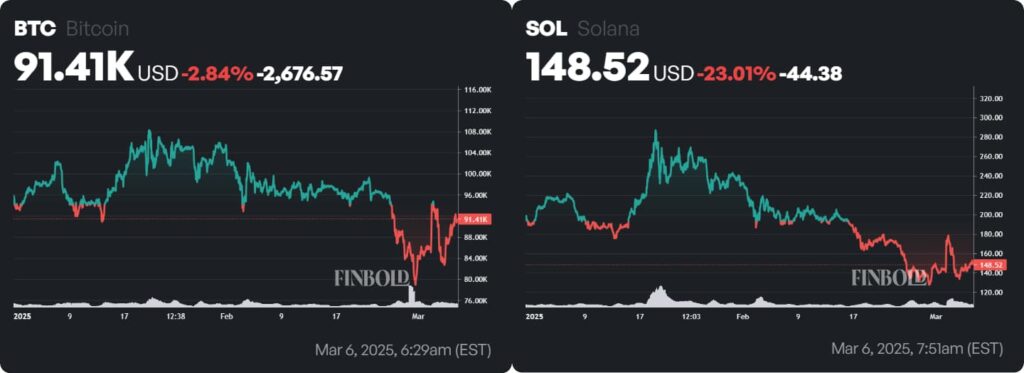

Bitcoin is down 2.84% year-to-date, trading at $91,419, amid persistent macroeconomic headwinds. The flagship cryptocurrency briefly plunged below $85,000 after Trump’s announcement of 25% tariffs on U.S. imports from Canada and Mexico, triggering a market-wide selloff and wiping out over $985 million in liquidations.

The downturn erased gains from a short-lived rally sparked by Trump’s March 2 announcement of a strategic crypto reserve, which had initially boosted sentiment in the digital asset market.

However, Bitcoin rebounded sharply, surging to $92,700 after Trump postponed new automobile tariffs on Canada and Mexico for a month, easing investor concerns.

Altcoins take a harder hit

While Bitcoin has managed to recover some losses, Solana, which Scaramucci and SkyBridge Capital have favored over Ethereum (ETH), has taken a significant hit, dropping 23% to $148.

BTC and SOL price year-to-date (YTD) charts. Source: Finbold

BTC and SOL price year-to-date (YTD) charts. Source: Finbold

Other altcoins in his portfolio have performed even worse. Avalanche has plunged 38% to $22, while Polkadot has fallen 31% to $4.58, as risk-off sentiment and regulatory uncertainty continue to weigh on the broader crypto market.

AVAX and DOT price year-to-date (YTD) charts. Source: Finbold

AVAX and DOT price year-to-date (YTD) charts. Source: Finbold

A $1,000 investment : Where does it stand now?

Taking all these factors into account, a $1,000 investment split evenly between Bitcoin, Solana, Avalanche, and Polkadot would have suffered a 23.34% loss, bringing the portfolio’s total value down to $766.58.

While his high-conviction bets on Bitcoin and select altcoins have delivered strong returns in past bull cycles, the portfolio’s performance equally highlights the vulnerabilities of a narrowly focused approach.

A more diversified portfolio, incorporating stablecoins and a broader mix of cryptocurrencies, could help cushion against sharp market swings.

Still, with signs of a short-term recovery taking shape, the focus now shifts to whether this rebound can gain momentum and turn into a sustained rally in the months ahead.

Featured image from Shutterstock