Here’s why Dogecoin (DOGE) price is set to soar 180%

Here’s why Dogecoin (DOGE) price is set to soar 180%

![]() Cryptocurrency Oct 2, 2024 Share

Cryptocurrency Oct 2, 2024 Share

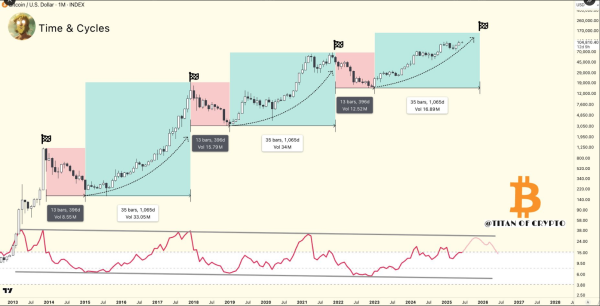

Leading meme cryptocurrency Dogecoin (DOGE) could be on the verge of a notable rally based on the technical outlook, as identified by a prominent trading expert.

The potential rally coincides with a period when DOGE has traded in tandem with the general market while witnessing increased onchain activity, such as a spike in the number of new addresses.

Regarding the growth potential, Dogecoin’s weekly chart shows that the Moving Average Convergence Divergence (MACD) indicator signals a potential bullish crossover. If realized, it could lead to a 180% rally, as noted by Ali Martinez in an X post on October 1.

Picks for you

Long squeeze alert as US stocks bullish sentiment went 'through the roof' 7 mins ago Gold is 'on track for its best annual return since 1979,' data suggests 2 hours ago Anonymous trader turns $368 into $2 million in three days 3 hours ago Here is how much the value of X has fallen since Elon Musk bought it 4 hours ago

This pattern has historically strongly predicted major upward price movements for DOGE. In one instance, Martinez observed that Dogecoin surged by 90%, and on another occasion, the price skyrocketed by 180%.

These breakouts were triggered by the same MACD pattern that now seems to be forming again, with the meme coin stabilizing around the $0.10 range. Therefore, if Dogecoin surges by 180%, the token could trade at $0.29.

Dogecoin price analysis chart. Source: TradingView/Ali_charts

Dogecoin price analysis chart. Source: TradingView/Ali_charts

In keeping with the bullish outlook for Dogecoin, a crypto analyst with the pseudonym Lucky acknowledged in an X post on October 1 that the meme token has witnessed solid upward movement, and technical indicators hint at a possible continuation.

He observed that after breaking out of a descending wedge, which had been forming since mid-April, DOGE bounced from key support levels. Fibonacci extension levels also indicated potential price targets near $0.22 and beyond.

Dogecoin price analysis chart. Source: TradingView

Dogecoin price analysis chart. Source: TradingView

Dogecoin records spike in on-chain activity

Meanwhile, the possibility of Dogecoin surging is backed by on-chain activity, where Martinez observed a spike in active addresses over the past six months. As of October 2, the figure had hit 84,306, according to data sourced from the crypto analysis platform Santiment.

In the same breadth, another data set shared by Santiment noted that although DOGE has dropped recently, whale investors largely remain interested in the token. Notably, 1,203 whale transactions (each over $100,000) were recorded in the lead-up to the September 28 peak, the highest level of whale activity since May.

Additionally, 63,689 DOGE addresses transferred coins in just three days, the most extensive stretch since April 2-4, highlighting significant movement on the network. Therefore, it can be assumed that sustained on-chain activity suggests whales may still be positioned for more upside.

Dogecoin whale transactions. Source: Santiment

Dogecoin whale transactions. Source: Santiment

Dogecoin’s next price target

As things stand, Dogecoin’s main target is claiming the $1 spot, with analysts such as Trading Shot stressing that the meme coin is primed for further gains to a potential high of about $2.

Indeed, such momentum will need the input of the general market, especially with the possible onset of an altcoin season. At the same time, DOGE could benefit from any bullish sentiment from backers such as Tesla (NASDAQ: TSLA) CEO Elon Musk. Although Musk’s influence on DOGE has appeared to fade, the possible incorporation of the token in his companies would be a bullish fundamental.

DOGE price analysis

At press time, DOGE was trading at $0.105, dropping over 7% in the last 24 hours. On the weekly chart, the token is down 3%.

Dogecoin seven-day price chart. Source: CoinMarketCap

Dogecoin seven-day price chart. Source: CoinMarketCap

In summary, technical indicators and on-chain data suggest that Dogecoin is primed for possible growth. However, the meme coin remains subject to overall market trading patterns, and investors need to monitor how DOGE interacts with the $0.10 support, as a drop below this level could spell more losses.