Last Week Bitcoin Was Down but No One Counted It Out

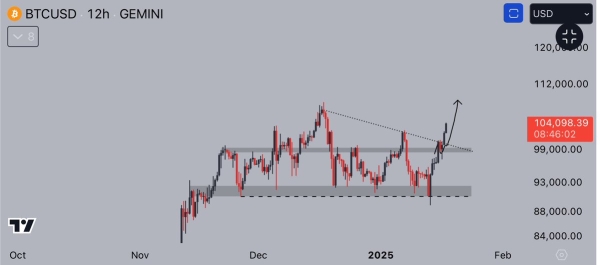

It’s instructive to look back to see how much difference one week can make. Participants weathered volatile bitcoin price action, the marque crypto asset dropped 10%. Despite spot bitcoin ETF outflows and macroeconomic concerns on the negative side, the bullish sentiment around blockchain activity on the positive helped keep most people bullish.

This editorial is from last week’s edition of the Week in Review newsletter. Subscribe to the weekly newsletter to get the editorial the second it’s finished.

A Week Ago Signals Were Mixed: ETF Outflows, Silk Road Bitcoin Sales, and a Glimpse of Bullish Hope

After starting the week pumping 4%, bitcoin, as of writing this, is down 10%. It’s safe to say that the market has experienced volatility this week, with several factors likely contributing to the current price action. On the negative side, there have been substantial outflows from both bitcoin and ethereum ETFs. Also, Thursday a U.S. court granted the Department of Justice approval to sell $6.5 billion worth of bitcoin seized from the Silk Road assets. Hopefully, the Biden-led executive will not do so with less than two weeks remaining in power.

On the positive side, Chilean legislators are considering a proposal to create a strategic bitcoin reserve. I expect more countries are thinking about it behind closed doors. Despite prices having declined from Tuesday, sentiment online has largely remained positive. On a somewhat related note, the number of bitcoin obituaries – predictions of bitcoin’s demise – appears to be decreasing over time. Even the naysayers don’t think bitcoin is going anywhere.

This year still looks positive for bitcoin and crypto. The biggest concern moving forward is macro forces that might delay crypto strength in H1. Things such as the long end of the U.S. yield curve not behaving well, or inflation rising due to Trump tariffs.

What has not been positive is the artificial intelligence (AI) sector. After running up and to the right pretty much since late November, AI crypto darling VIRTUAL, which is a bellwether of the whole sector, has been red for 7 of the last 8 days. AI memecoin GOAT is down 72% from its ATH, and FARTCOIN is 48% off its high. This all seems healthy, as the sector was getting way ahead itself – there are basically no useful products yet!

In other news, this Bitcoin.com News interview with Fredrik Haga, Co-founder and CEO of Dune Analytics covered, among many things, their new product Dune Index. Index is Dune’s foray into measuring the comparative strength of blockchains. In their words, they’re measuring “blockchain adoption.” Ethereum and Solana supporters argued all last year about which metrics mattered most. The problem was, that each side chose metrics that made their respective chain look the best. It’s nice to see someone with a bit less bias weighing in.

Bitcoin.com Marketing Lead Graham Stone pointed out in this week’s episode of Token Narratives that the overall composite of Dune Index looks like it might correlate well with the total crypto market cap. This needs further investigation, but makes sense to me since part of what Index is trying to measure is blockchain activity. On-chain activity has been shown to correlate reasonably well with price. Take a look at the Dune Index, it’s pretty damn bullish.