Monero adds $2 billion in market cap following hack

Monero adds $2 billion in market cap following hack

![]() Cryptocurrency Apr 28, 2025 Share

Cryptocurrency Apr 28, 2025 Share

Summary

⚈ Monero’s market cap surged by $2 billion following a suspicious hack-related rally.

⚈ Crypto investigator ZachXBT flagged a $330 million Bitcoin transfer linked to the hack.

⚈ Monero prices are expected to quickly fall back to pre-hack levels.

Monero (XMR) has seen a sharp, sudden, and suspicious increase in both trading volume and price over the past 24 hours.

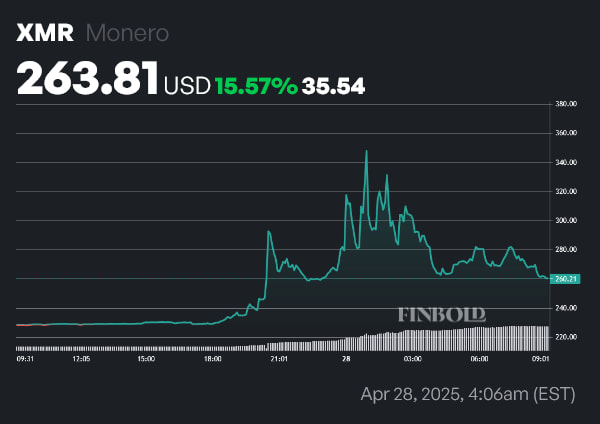

As of press time on April 28, XMR is changing hands at a price of $263.81, and is up 15.57% on the daily chart. However, the token reached an intraday high of $347.72, some 31.80% higher than current prices.

XMR price 1-day chart. Source: Finbold

XMR price 1-day chart. Source: Finbold

The move to the upside was so significant that it even saw Monero reach a market capitalization of $6.23 billion, up from $4.21 billion before the sudden rally.

Unfortunately for XMR bulls, the development seems to be the result of a hack, and likely won’t last.

Crypto detective flags Monero hack

ZachXBT, an on-chain investigator and analyst who has covered and discovered numerous instances of malfeasance in the cryptocurrency space, flagged a suspicious transfer in an April 28 X post.

The transfer in question saw 3,520 Bitcoins (BTC) worth $330.7 million at the time transferred to the following address: bc1qcrypchnrdx87jnal5e5m849fw460t4gk7vz55g, after which the BTC was sent to at least six different instant exchange platforms.

Nine hours ago a suspicious transfer was made from a potential victim for 3520 BTC ($330.7M)

Theft address

bc1qcrypchnrdx87jnal5e5m849fw460t4gk7vz55gShortly after the funds began to be laundered via 6+ instant exchanges and was swapped for XMR causing the XMR price to spike…

— ZachXBT (@zachxbt) April 28, 2025

In support of the hack thesis, ZachXBT outlined several points. The victim was a long-term BTC holder and a regular user of exchanges such as Coinbase, Gemini, and River.

Moreover, this latest line of transactions came suddenly, used small increments and instant exchanges, and most likely led to multiple 7-figure losses from fees — a highly inefficient way to conduct legitimate trading. In addition, as most exchanges do not accept Monero, there’s not much liquidity to go around — making it easier to pump its price this way.

that’s how you know it’s likely a theft

>longtime Bitcoin holder

>is a Gemini, River, Coinbase, etc user

>$330M suddenly moved today and transferred in small increments to instant exchanges, creating hundreds of orders

>gonna lose multiple 7 figs to fees / inefficient for…— ZachXBT (@zachxbt) April 28, 2025

With the liquidations concluded, Monero prices will most likely return to pre-hack levels in short order.

Featured image from Shutterstock