‘Money Printing’ Will Lift Bitcoin to $250K This Year: Arthur Hayes

Bitcoin’s price will more than double within the next six months, swelling to $250,000, according to Bitcoin billionaire and BitMEX co-founder Arthur Hayes, as U.S. President Donald Trump moves away from the market-rattling impact of tariffs toward other fiscal policies.

“Midterm elections are coming up in the U.S.,” he told Decrypt at Bitcoin 2025 in Las Vegas. “While the Trump administration went hard on tariffs and was taking this market pain for the last three months, that narrative has to shift.”

Instead of pursuing trade policies that could weigh on economic growth and potentially hurt Americans’ ability to afford everyday goods, Hayes—who has made his fair share of bold predictions—argued that the president will have to show he “brought goodies for the population” to help Republicans at the ballot box come 2026.

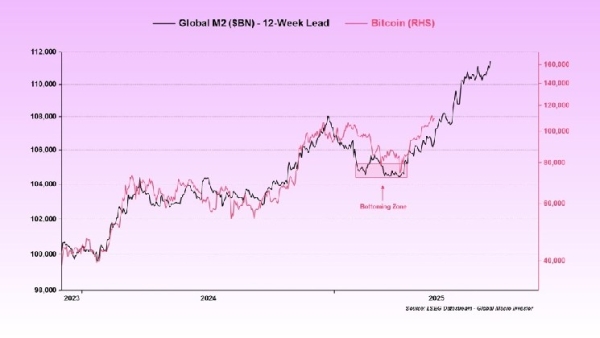

“They’re going to accelerate the money printing,” Hayes said, referring to the Federal Reserve—an independent government agency that is primarily responsible for managing the U.S. money supply.

Among policies that U.S. Treasury Secretary Scott Bessent has teased as fiscal stimulus, Hayes highlighted potential changes to Fannie Mae and Freddie Mac, government-backed mortgage giants that have been under government oversight since the 2008 financial crisis.

If the government-sponsored enterprises are allowed to go public and raise capital again, that would inject cheap liquidity into the housing market, Hayes said. Allowing them to “lever up their balance sheets” would also make mortgages more affordable, he said. Among knock-on effects, increased housing activity could theoretically spur economic growth and support risk-on assets.

On top of that, discussions surrounding a so-called supplemental leverage ratio, or SLR, exemption for U.S. Treasuries are bullish, Hayes said. In essence, the White House wants to ease leverage ratios for banks when it comes to their exposure to U.S. debt.

“That allows the U.S. banking system to apply infinite leverage to buy treasury bonds is obviously very positive for global capital markets,” he added.

Finally, Hayes sees the government shifting from tariffs to capital controls to support American manufacturing in a more politically palatable way. Instead of taxing imports, the U.S. could tax foreign government holdings of bonds, equities, and land that stem from trade long-running trade imbalances.

How that could drive governments toward gold and Bitcoin is a central theme of his latest essay, which also predicts that Bitcoin will hit $1 million before 2028. Earlier this month, Hayes predicted that Bitcoin would hit $150,000 this year, as opposed to $250,000.

Billionaire investor Tim Draper made a similar call this month, highlighting regulatory tailwinds for the asset under the Trump administration. Bitcoin’s path to $250,000 this year will also be bolstered by myriad firms adopting Bitcoin as a treasury reserve asset, he said.

With Congress weighing legislative initiatives that could potentially establish rules for stablecoins and create a regulatory taxonomy for many coins, Hayes also told Decrypt that Ethereum will make its own comeback this year, rising as high as $5,000.

Edited by James Rubin