Solana price analysis as SOL ETF filings disappear from Cboe

Solana price analysis as SOL ETF filings disappear from Cboe

![]() Cryptocurrency Aug 17, 2024 Share

Cryptocurrency Aug 17, 2024 Share

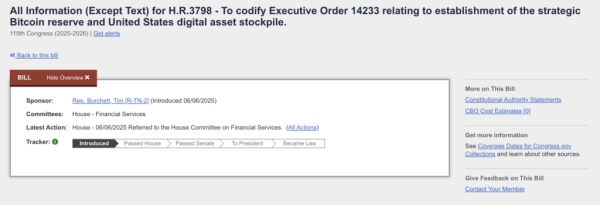

Cryptocurrency investors and commentators noticed this Saturday morning, August 17, that Solana (SOL) ETF filings disappeared from the Chicago Board Options Exchange (Cboe), raising a bearish sentiment and potentially affecting the token’s price.

Notably, Cboe removed the 19b-4 filings for VanEck and 21Shares’ spot Solana ETFs from its website, raising concerns. On X, content creators and commentators speculate on a possible withdrawal of these filings from their issuers.

Despite approving Bitcoin (BTC) and Ethereum (ETH) exchange-traded funds, the Securities and Exchange Commission (SEC) did not show intent to approve Solana’s trusts amid investigations of SOL being an unregistered security.

Picks for you

R. Kiyosaki says 'the Fed cannot save you' amid recession fears, names assets to buy 1 hour ago SUI price analysis as the so-called "Solana killer" loses momentum 18 hours ago AI predicts Ethereum price for August 31, 2024 19 hours ago XRP price bullish breakout build-up ahead of rally to $27 21 hours ago

In Brazil, however, the Solana-backed ETF is moving forward after regulators gave it a green light. Interestingly, BlackRock (NYSE: BLK) recently commented on a lack of interest in cryptocurrencies other than BTC and ETH.

Solana (SOL) price analysis

As of this writing, SOL was trading at $139.08, down 2.91% in the last 24 hours. This recent price action suggests Solana investors could be selling amid the negative news about ETF filings.

On August 10, SOL was trading at $154.44 per token, accumulating nearly 10% losses in the last seven days. The losses are even higher in the 30-day time frame, with a negative 12.66% price performance. Conversely, Solana’s price is up 25% in the last six months, but investors must be cautious now.

Solana (SOL) 24-hour price chart. Source: Finbold

Solana (SOL) 24-hour price chart. Source: Finbold

Summing up the speculation, Nate Geraci, an ETF expert—president, host, and co-founder of ETF-related businesses—commented that:

“Solana ETF not happening anytime soon under current administration.”

Many position and swing traders were speculating on the SEC’s approval of Solana ETFs, which would end regulatory uncertainties. Following the recent news, these speculators are likely to sell, creating supply pressure on SOL.

Moreover, Solana is known for having one of the highest supply inflations of the entire cryptocurrency market. The constant injection of new tokens into the market already pressures the price to the downside. So far, growing demand for SOL has proven enough to face the increasing supply, but things could change with a sentiment shift.

The market now closely watches the SEC, the Cboe, and the Solana ecosystem for insights on what to expect next.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.