These catalysts could propel XRP past the $1 mark

These catalysts could propel XRP past the $1 mark

![]() Cryptocurrency Jul 21, 2024 Share

Cryptocurrency Jul 21, 2024 Share

XRP (XRP) has been on a dramatic ride in recent months, influenced by a mix of internal dynamics and external pressures. Starting from the second week of July, the cryptocurrency experienced a significant recovery, driven by mounting expectations of a settlement in the SEC v. Ripple case.

This optimism was initially sparked by news of a closed meeting at the United States Securities and Exchange Commission (SEC), which led to a sharp recovery. Consequently, XRP surged from $0.40 to a high of $0.6387.

However, the price retreated to a low of $0.54 after the SEC announced the cancellation of its closed meeting. Over the past two weeks, XRP has surged more than 35%, with traders eagerly anticipating a significant move.

Picks for you

2 cryptocurrencies with a better 'Network Value-to-Transaction' than Bitcoin 14 mins ago Bitcoin 'Magic Bands' predicts BTC's next immediate record high 1 hour ago Crypto investors vote with $4 million to launch an APE-themed hotel in Bangkok 2 hours ago Crypto trader capitulates from a $2 million position, joins whales' trend 4 hours ago

Based on its recent trajectory, crypto analyst Dark Defender has suggested that the token’s technical indicators signal a potential breakout.

Technical analysis and price targets

According to technical analysis, the 4-hour time frame chart for XRP/USD reveals a structured correction in progress, starting from $0.60 with targets at $0.5409 and possibly $0.499.

The Elliott Wave count indicates this correction is part of a broader bullish trend following a 5-wave impulse sequence. Additionally, significant Fibonacci retracement levels at 23.60% and 161.80% provide potential support zones at $0.5233 and $0.4965, respectively.

XRP price analysis chart. Source: Dark Defender / X

XRP price analysis chart. Source: Dark Defender / X

Moreover, several other technical indicators suggest XRP could surpass the $1 mark. The relative strength index (RSI) indicator is currently in a neutral zone, indicating that XRP is neither overbought nor oversold.

This balanced condition provides a conducive environment for a potential breakout. Typically, a rising RSI coupled with movement above key resistance levels precedes significant upward price action, potentially pushing XRP towards and beyond the $1 mark.

Additionally, the completion of the C Wave around $0.499 to $0.5409, coupled with the identified Fibonacci support levels, suggests a strong upward move is imminent.

Additional factors supporting XRP’s bullish outlook

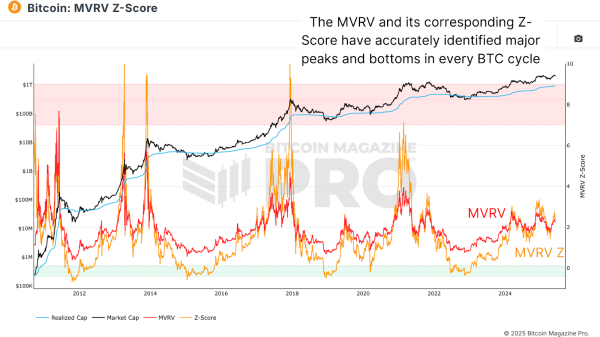

Beyond technical indicators, broader market dynamics also play a critical role. The overall bullish trend in the cryptocurrency market typically lifts all major altcoins, including XRP.

Bitcoin’s (BTC) performance often sets the tone for altcoin prices, and a continued uptrend in BTC could positively influence XRP. Moreover, institutional interest in cryptocurrencies is on the rise, with more funds and large investors considering altcoins like XRP for diversification.

Furthermore, according to Santiment, the XRP Ledger has seen a significant increase in activity. Recently, 1,721 new XRP wallets were created in a single day, the highest since March 30.

Additionally, 47,363 individual addresses interacted on the XRP network, marking the highest activity since March 9.

This surge in wallet creation and network interaction highlights the growing interest and participation in the XRP ecosystem, further supporting its bullish outlook.

XRP price analysis

At the time of reporting, XRP was valued at $0.59, reflecting a slight 0.16% decrease over the past 24 hours but a notable 12% increase over the past 14 days.

XRP 7-day price chart. Source: Finbold

XRP 7-day price chart. Source: Finbold

The current technical setup favors a bullish breakout, with the $1 target emerging as an exciting possibility for investors. Historical trends suggest that once XRP gains momentum, it can swiftly achieve significant price milestones.

As the market dynamics continue to evolve, investors should stay vigilant for any breakout signals, which could present substantial trading opportunities in the near future.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk