This bullish setup maps Ethereum’s price roadmap to $7,400 in 2025

This bullish setup maps Ethereum’s price roadmap to $7,400 in 2025

![]() Cryptocurrency Jan 23, 2025 Share

Cryptocurrency Jan 23, 2025 Share

Ethereum (ETH) is charting a bullish course, with technical indicators hinting at a potential rally.

According to a recent analysis by Titan of Crypto, Ethereum appears to be forming a potential Inverse Head and Shoulders (H&S) pattern within an upward channel, with a target of $7,400 in sight.

If confirmed, this pattern could signal the beginning of a significant upward move in the coming months.

Picks for you

ChatGPT says Silver price will hit this target in 2025 52 mins ago Solana makes new all-time high in stablecoin value – What’s next for SOL? 2 hours ago Trump meme coin sees $38 billion in trading since launch 2 hours ago Here’s how much Bitcoin BlackRock has bought in 2025 3 hours ago

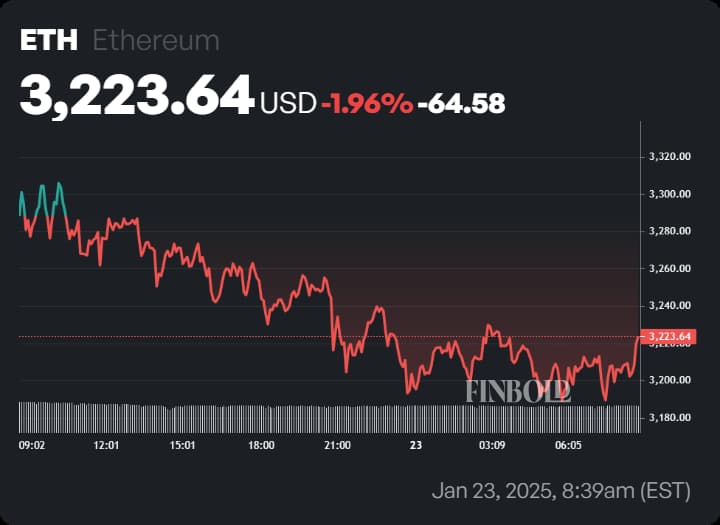

However, at press time, Ethereum is trading at $3,223, reflecting a daily decline of 1.96% and a weekly drop of nearly 3%, indicating the current market uncertainty.

Ethereum one-day price chart. Source: Finbold

Ethereum one-day price chart. Source: Finbold

Ethereum technical analysis paints a bullish picture

The inverse Head and Shoulders pattern, a widely recognized bullish reversal structure, is becoming increasingly apparent in Ethereum’s current price action. The neckline, which serves as a critical resistance level, is positioned above the current price near $4,000.

Ethereum price analysis chart. Source: Titan of Crypto / X

Ethereum price analysis chart. Source: Titan of Crypto / X

A decisive breakout above this neckline, backed by substantial trading volume, could validate the pattern and set the stage for a significant upward move.

Further supporting this bullish narrative, the Fibonacci extension at 127.20% points to a target of $7,442, aligning closely with the projection from the H&S setup.

Since early 2023, Ethereum has been trading within a well-defined upward channel, offering consistent support and resistance levels. This channel strengthens Ethereum’s broader bullish momentum, with the technical framework signaling the potential for further gains.

Ethereum’s bullish confluence with Ascending Triangle

Adding to the bullish case, long-term crypto investor Jelle identified that Ethereum is showcasing a compelling technical setup on the weekly chart, with two significant bullish patterns developing simultaneously.

Jelle noted that the inverse H&S pattern is forming with the neckline resistance around $4,000, within the broader structure of an ascending triangle, another bullish continuation signal.

Head & Shoulders pattern, inside a massive ascending triangle.

.eth bro's slowly capitulating as we form the right shoulder.

This could get interesting quickly.

Price discovery soon?$ETH pic.twitter.com/LJj7KAnDZz

— Jelle (@CryptoJelleNL) January 22, 2025

This confluence of bullish signals has the market on edge, as traders anticipate a potential breakout that could lead to price discovery.

Ali Martinez, another noted analyst, observed a similar pattern on January 17. According to Martinez’s analysis, Ethereum’s price could surge as high as $6,750, reflecting a 110.56% upside from its current level.

This projection aligns closely with the bullish targets identified by other analysts, further reinforcing the optimism surrounding Ethereum’s technical setup.

On-chain metrics show bullish momentum

Ethereum’s bullish projection is not only supported by technical patterns but also by several key on-chain metrics and fundamental developments.

Wallets holding between 1,000 and 10,000 ETH have substantially increased their holdings, adding 330,000 ETH since January 7, 2025. At the current price, this accumulation amounts to approximately $1.08 billion.

Historical data suggests this activity could precede a significant rally—previously when the same cohort accumulated 620,000 ETH, Ethereum’s price surged from $2,400 to $4,000.

Further strengthening the bullish narrative is a notable spike in Network Growth, with 180,000 new addresses created recently. This metric, which measures new capital inflows into the ecosystem, signals heightened interest in Ethereum.

Ethereum network growth. Source: MAXPAIN/X

Ethereum network growth. Source: MAXPAIN/X

A similar surge in April 2024 was followed by a price rally from $2,800 to $4,000, highlighting the strong correlation between network growth and price performance.

Looking ahead, artificial intelligence (AI) models forecast a near-term target for Ethereum at $3,750 by the end of Q1 2025, assuming continued market activity and strong demand.

Conversely, in a bearish scenario driven by macroeconomic pressures or reduced liquidity, Ethereum’s price could retrace to $3,000 showing the influence of external factors on its performance.

Meanwhile, investor sentiment has increasingly shifted toward altcoins and meme coins, which have posted notable gains in recent weeks, with Ethereum lagging behind in capturing the broader market’s enthusiasm.

Featured image via Shutterstock