This Indian Company Just Went All-In on Bitcoin: Here’s Why

Siddarth Bharwani, CFO of Jetking, the first Indian publicly listed company to adopt the Bitcoin standard, said his company adopted the cryptocurrency to escape the difficulties of the past pandemic and protect against similar situations in the future.

In a recent interview, Bharwani explained how they decided on the Bitcoin option, highlighting the investment potential of the digital asset.

Jetking is India’s first publicly traded company to adopt the Bitcoin Standard. CFO @SidBharwani of @JetkingLtd explains why in the interview below:

Timecodes:

00:00 – Intro

01:53 – The story of Jetking; Who is Siddarth Bharwani?

04:47 – Why adopt Bitcoin for Jetking’s balance… pic.twitter.com/ZvyToehiMx— Michael Saylor⚡️ (@saylor) February 9, 2025

The Jetking CFO explained that his firm decided to go for the Bitcoin option after doing a lot of research. They also observed developments around the technology. He compared Bitcoin with other mainstream assets, highlighting the limitations of real estate and gold among other asset classes. According to Bharwani, Bitcoin stood out as a better option, leading to Jetking taking a position in the digital asset market in 2022.

Related: Bitcoin Is a Transformative Investment Opportunity, Says World-Class Investor

Bitcoin as Treasury Reserve, Despite India’s Crypto Rules

Initially, Jetking allocated 25% of its investable surplus to Bitcoin, according to Bharwani. The firm explored the crypto industry’s dynamics until March 2024, after the launch of multiple ETFs in the US signaled the institutionalization of Bitcoin. Despite India’s strict rules, Jetking adopted Bitcoin as its treasury reserve asset.

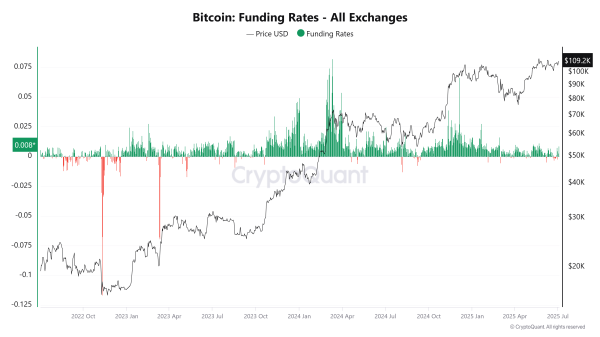

When asked about Bitcoin’s volatility and the post-2022 bear market, Bharwani stated that his company remained confident even though BTC tumbled to around $15,000 after they bought their initial allocation for about $45,000. According to the CFO, his firm’s confidence stemmed from a historical study of Bitcoin’s price behavior and the cryptocurrency’s tendency to rebound after significant pullbacks.

Long-Term Bitcoin Strategy, Like Saylor

Currently, Bharwani noted that Jetking has adopted a Bitcoin investment policy similar to Michael Saylor’s Strategy. The company intends to continue buying Bitcoin without focusing on the prevailing price, considering it has a Bitcoin investment plan that could span over 20 years.

Related: MicroStrategy’s Bitcoin Investment Hits $745M Unrealized Profit

According to Bharwani, Jetking did not enter the Bitcoin market as a trader trying to profit from price fluctuations but as an investor focusing on the digital asset’s long-term growth.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.