This price range is Bitcoin’s next stop, according to analyst

This price range is Bitcoin’s next stop, according to analyst

![]() Cryptocurrency Aug 23, 2024 Share

Cryptocurrency Aug 23, 2024 Share

Bitcoin (BTC) has rebounded from its early August slump, with the leading cryptocurrency now trading above $60,500 and eyeing the $65,000 resistance level.

Following this recent movement, crypto analyst Titan of Crypto has observed that the asset has hit several technical indicators, positioning it for a potential new high.

In an X post on August 22, the analyst noted that Bitcoin could be gearing up for a rally from its current levels, pointing to key technical signals that suggest bullish momentum is building.

Picks for you

Economist revises Bitcoin and S&P 500 targets that will usher in recession 2 hours ago Jack Schlossberg’s net worth revealed: How rich is JFK’s only grandson? 2 hours ago R. Kiyosaki reveals differences between investing in Bitcoin and real estate 5 hours ago Here’s why analysts think Bitcoin’s bull flag could spark a rally in Q4 2024 5 hours ago  Bitcoin price analysis chart. Source: TradingView

Bitcoin price analysis chart. Source: TradingView

Bitcoin’s Moving Average Convergence Divergence (MACD) experienced a bullish crossover, a signal often interpreted as a precursor to upward price action. This crossover, combined with a successful retest of previous support levels, has laid the groundwork for what could be Bitcoin’s next substantial rally.

Historically, each crossover has been followed by significant upward movements, ranging from 11% to 19%, reinforcing the reliability of this indicator in predicting Bitcoin’s price action.

The first observed crossover led to a strong rally in late April, where Bitcoin gained over 11% after a brief retest of support levels. A similar pattern emerged in early July, resulting in an 18.73% surge, though this move was briefly interrupted by a fakeout before continuing its upward trend.

The most recent crossover, which occurred in mid-August, coincided with a breakout from a downward trend. It was followed by another retest that Titan of Crypto interprets as a confirmation of Bitcoin’s next move upward.

Given the historical accuracy of these patterns, Titan of Crypto suggested that Bitcoin could be on track to reach the $68,000 mark in its next upward leg.

Significance of Bitcoin closing above 2021 record high

Notably, if Bitcoin hits the $68,000 mark, it will surpass its all-time high in 2021. In this context, crypto analyst ElCryptoProf, in an X post on August 23, observed that Bitcoin is on the verge of closing its seventh consecutive monthly candle above the previous all-time high set in 2021. This prolonged period of resilience underscores the growing support for Bitcoin at these elevated levels.

Bitcoin price analysis chart. Source: TradingView

Bitcoin price analysis chart. Source: TradingView

Historically, higher timeframes, such as monthly charts, provide more reliable signals of market direction. With Bitcoin maintaining its position above the 2021 record high, the analyst viewed this as a highly bullish indicator.

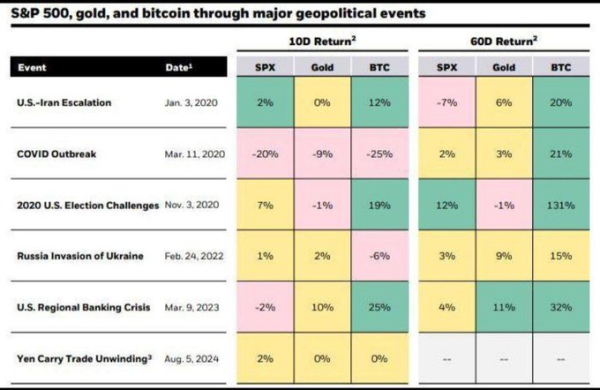

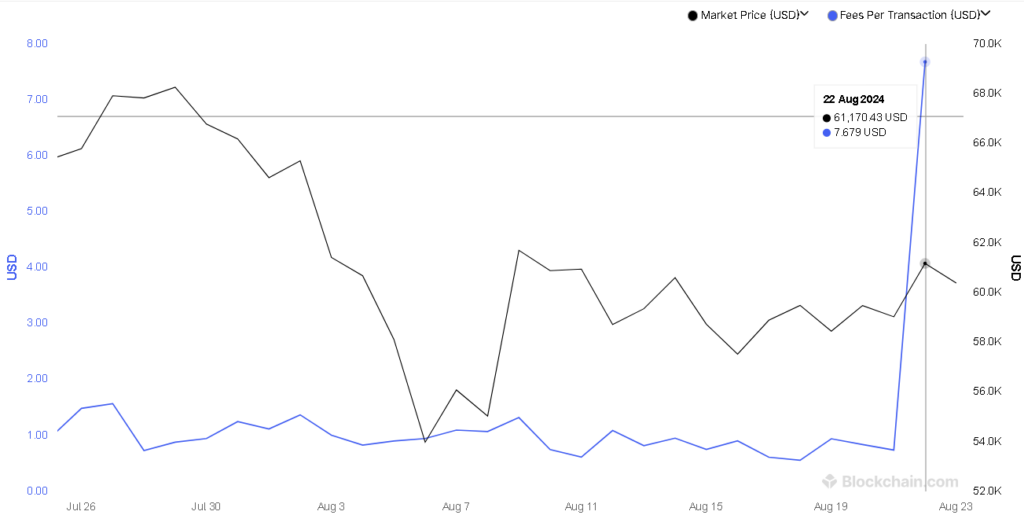

Indeed, the current Bitcoin price movement has coincided with a period of increased network activity. Particularly, as of August 22, Bitcoin’s average transaction fee surged by 937.7%, rising from $0.74 to $7.679 per transaction, primarily driven by heightened network demand.

Since July, Bitcoin’s average transaction fees have remained relatively stable, consistently trending below the $2 mark. On August 18, the fees even reached historic lows of $0.558. While lower costs make it more accessible for the general public to transfer Bitcoin, they may negatively impact miners’ revenue.

Bitcoin transaction fees chart. Source: Blockchain.com

Bitcoin transaction fees chart. Source: Blockchain.com

Bitcoin price analysis

At the time of reporting, Bitcoin was trading at $60,850, having rallied about 0.2% in the last 24 hours. On the weekly chart, BTC has maintained its price in the green zone, rallying by 4.6%.

Bitcoin seven-day price chart. Source: Finbold

Bitcoin seven-day price chart. Source: Finbold

Although technical indicators suggest that Bitcoin is poised for new highs, investors should closely monitor other macroeconomic factors, such as the Federal Reserve’s interest rate decisions, amid lingering concerns regarding a possible recession.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.