Top 10 XRP holders own 35% of all tokens

Top 10 XRP holders own 35% of all tokens

![]() Cryptocurrency Dec 23, 2024 Share

Cryptocurrency Dec 23, 2024 Share

XRP is among cryptocurrencies with concentrated ownership in a few top addresses, raising concerns about the impact of centralization.

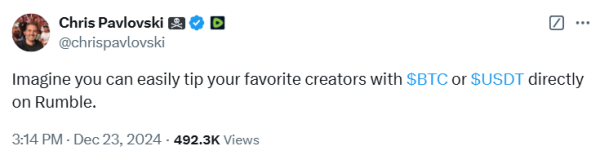

A breakdown of ownership indicates that Ripple-controlled addresses account for most of the asset, primarily locked in escrow. Major exchanges also rank among the top holders.

The top 10 XRP holders collectively own 35.39% of the total supply, amounting to 27.53 billion tokens. Ripple dominates this list, with its seven accounts holding 24.53 billion XRP, including tokens in escrow, representing 31.57% of the total supply, according to data retrieved by Finbold from XRP Scan on December 23.

Picks for you

MicroStrategy buys Bitcoin price top at $106k, already down 12% 7 hours ago This crypto is down 42% and screams “buy” right now (Hint: Not XRP) 9 hours ago AdEx releases AURA, an AI-driven Web3 activity analyzer 10 hours ago North Korean hackers lose $400k trading crypto in just 2 days 11 hours ago

Additionally, Uphold and Bithumb features are available among the top owners. Uphold holds 1.86 billion XRP (1.86%), and Bithumb accounts for 1.39 billion XRP (1.39%).

XRP top ten holders. Source: XRP Scan

XRP top ten holders. Source: XRP Scan

XRP centralization concerns

Although Ripple has implemented a clear XRP management plan, the concentration of assets in a few company-affiliated addresses raises concerns about centralization. Critics argue this goes against the principles of blockchain decentralization and trustlessness.

For instance, cryptocurrency researcher Justin Bons challenged Ripple’s decentralization claims earlier in December, highlighting possible flaws in XRP’s design.

In an X post on December 3, Bons asserted that XRP relies on a centralized Unique Node List (UNL) and uses Proof of Authority (PoA), allowing the XRP Foundation to control validators and enforce compliance.

Bons further criticized XRP’s lack of validator incentives, a 99.8% pre-mine, and reliance on founder-held token sales, which he believes compromise fairness and transparency.

He recommended Ripple adopt a Proof of Stake (PoS) model to decentralize validator selection and promote transparency.

You are completely focused on a detail that absolutely does not matter in any realistic way. Validators are not compensated. They cannot censor unless node operators configure their code to allow them to.

They do resolve the double spend problem, but honest users don't double…

— David "JoelKatz" Schwartz (@JoelKatz) December 3, 2024

Financial educator and Bitcoin (BTC) advocate Rajat Soni echoed similar concerns, labeling XRP a ‘scam’ capable of enabling price manipulation.

Despite these criticisms, it is worth noting that Ripple does not control the XRP Ledger. Changes to the ledger require validator consensus rather than unilateral decisions. Furthermore, the total XRP supply has remained capped at 100 billion since its pre-mining phase.

XRP price analysis

As of press time, XRP was trading at $2.14, down nearly 4% in the last 24 hours and over 14% on the weekly chart. The bearish sentiment has hindered XRP’s trajectory toward the $3 resistance level.

XRP seven-day price chart. Source: Finbold

XRP seven-day price chart. Source: Finbold

XRP previously broke out of prolonged consolidation below $1, driven by post-election optimism following Donald Trump’s election and the upcoming departure of Securities Exchnage Commission (SEC) Chair Gary Gensler, which has boosted investor confidence.

Regarding the next price movement, crypto analyst Dark Defender noted in a December 22 post that XRP is consolidating within a descending triangle and testing a key support line around $1.80.

XRP price analysis chart. Source: Dark Defender

XRP price analysis chart. Source: Dark Defender

The daily chart highlighted resistance above $2.90. However, the Relative Strength Index (RSI) remains below the golden cross threshold, indicating weak bullish momentum. A breakout above resistance could trigger a rally, while a breakdown below support may lead to further declines.

Featured image via Shutterstock