Trading expert sets ultimate target for the crypto market this cycle

Trading expert sets ultimate target for the crypto market this cycle

![]() Cryptocurrency Jan 28, 2025 Share

Cryptocurrency Jan 28, 2025 Share

The total cryptocurrency market capitalization shows significant strength, breaking above previous cycle highs and consolidating gains after a deep correction.

This recovery has renewed optimism among investors and traders, with a prominent trading expert projecting the total market cap could reach an ambitious $10 trillion in this cycle.

Crypto market recovery gains traction

Long-term crypto investor Jelle highlights the market’s ability to recover after retesting lower levels as a critical sign of strength.

Picks for you

Gold quietly hits a record high amid DeepSeek volatility 6 hours ago This pattern signals a 'short-term momentum shift' for Dogecoin 7 hours ago The National DigiFoundry shares a new Web3 guide to secure information sharing 9 hours ago If you put $1,000 in Bitcoin when FTX’s Sam Bankman-Fried was sentenced, here's your return now 10 hours ago

With the market reclaiming key resistance levels and stabilizing, the setup appears ideal for further price discovery and potential upside in the months ahead, with $10 trillion in sight.

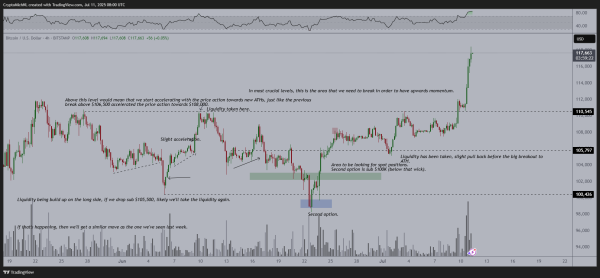

Total crypto market cap analysis. Source: Jelle/X

Total crypto market cap analysis. Source: Jelle/X

For instance, in Q4 2024, the total crypto market cap surged by 45.7%, adding $1.07 trillion to end the year at $3.40 trillion. This rally followed a local bottom in Q3 and gained momentum mid-Q4, coinciding with Donald Trump’s U.S. Presidential Election victory.

Over the course of 2024, the market cap nearly doubled, rising by 97.7% and peaking at $3.91 trillion in mid-December.

While it pulled back slightly to consolidate at $3.40 trillion, the market’s current consolidation phase signals a healthy pause, positioning it for further growth rather than weakness.

After a period of recent volatility, the total cryptocurrency market capitalization climbed by 1.5%, reaching $3.6 trillion. The market sentiment index also rose to 72, indicating a steady appetite for risk assets.

Despite this impressive recovery, the total market cap remains modest compared to traditional financial markets, such as equities and bonds. This highlights the sector’s significant growth potential, driven by rising adoption, increasing institutional investment, and growing retail participation.

Investment trends signal growing momentum

Investment inflows into crypto funds further highlight the sector’s positive momentum. According to CoinShares, global crypto fund investments totaled $1.858 billion last week, marking the third consecutive week of inflows.

Bitcoin (BTC) led with $1.591 billion, followed by Ethereum (ETH) at $205 million and XRP at $19 million. Solana (SOL) and Chainlink (LINK) also saw notable inflows, indicating growing interest in smaller assets.

Analysts attribute this surge to the Trump administration’s orders to evaluate the potential for a ‘national digital asset stockpile,’ a move that has improved institutional confidence.

Additionally, data from CryptoQuant shows an increase in large-scale Bitcoin investors, with the share of holders owning at least 1,000 BTC purchased in the last 155 days rising from 43% to 60%.

With the total cryptocurrency market cap stabilizing above key support levels and technical indicators signaling further growth, the $10 trillion target reflects the market’s vast potential.

While this projection may be ambitious, rising institutional participation, increasing retail adoption, and favorable macroeconomic conditions suggest that the crypto market has room to climb even higher.

Featured image via Shutterstock