Trump’s crypto revolution fuels Middle East’s digital finance ambitions

Trump’s crypto revolution fuels Middle East’s digital finance ambitions

![]() Cryptocurrency Mar 5, 2025 Share

Cryptocurrency Mar 5, 2025 Share

A quick look at the numbers reveals that the Middle East and North Africa (MENA) region has experienced remarkable crypto-related growth over the past year. This is thanks, in large part, to Bitcoin’s meteoric 120% rise (through 2024) which catapulted the sector’s market cap to a little under $3.8 trillion.

During this rise, the MENA region became the seventh-largest crypto market in the world, accounting for 7.5% of global transaction volume.

Moreover, numbers suggest that within nations like the UAE and Saudi Arabia, crypto enthusiasts have started to quickly move beyond centralized exchanges, with decentralized finance (DeFi) platforms fast gaining significant traction in the region.

Picks for you

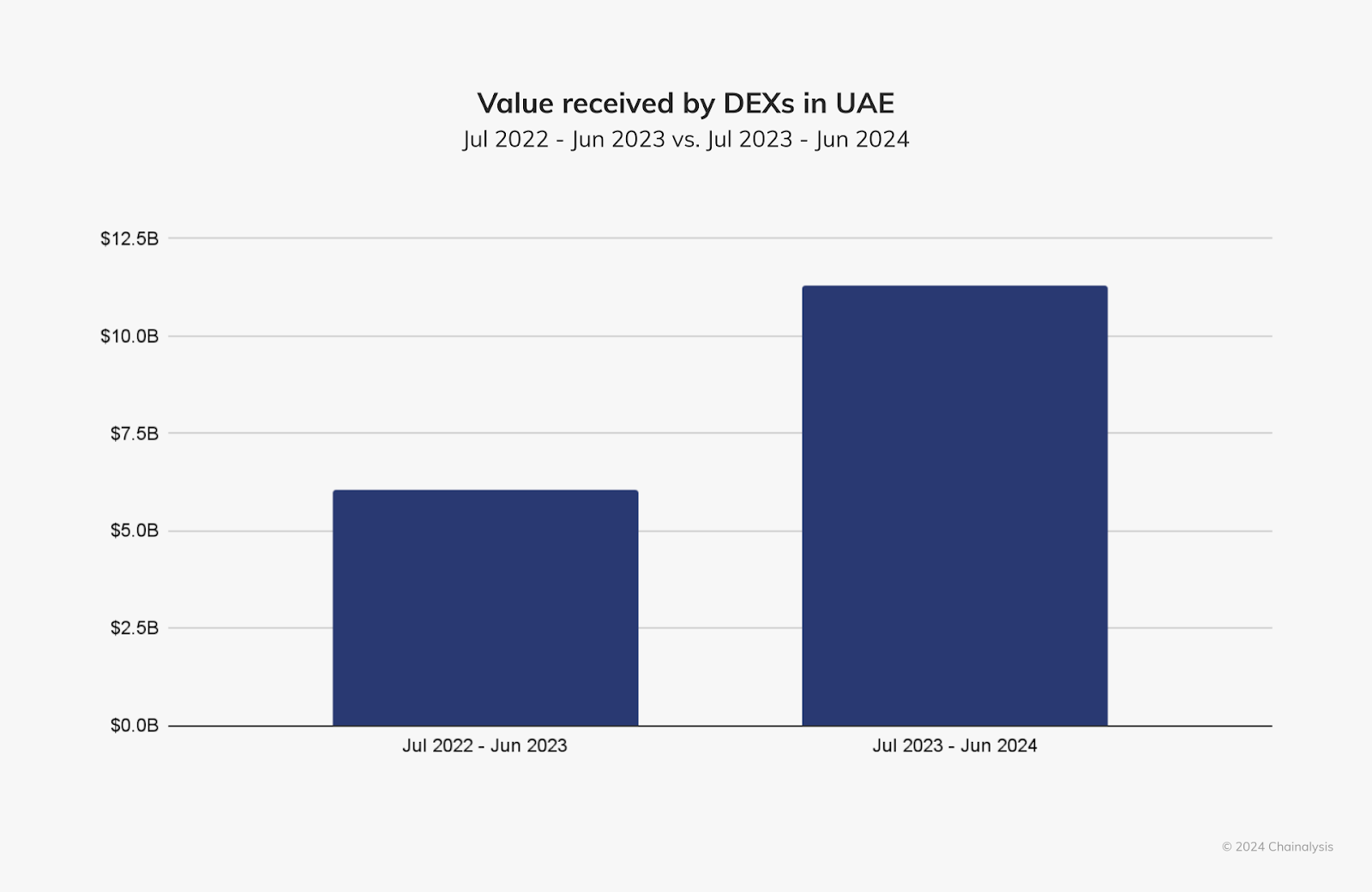

Sell alert: Solana (SOL) is facing a massive crash to $60, says analyst 37 seconds ago MultiversX poised to join tech giants with office in now revealed U.S. city 3 mins ago Bitcoin's bottom and bullish breakout is just a month away, according to analyst 1 hour ago AI predicts XRP price for March 31, 2025 3 hours ago  Value received by decentralized exchanges (DEXs) in the UAE. Source: Chainalysis

Value received by decentralized exchanges (DEXs) in the UAE. Source: Chainalysis

Trump’s second term to catalyze MENA’s crypto ambitions?

From the outside looking in, the return of Donald Trump to the US White House seems to have re-ignited the global digital asset fray, with implications extending far beyond America’s borders — especially into the MENA region.

For starters, Trump’s commitment to establishing clear regulatory frameworks in the United States has encouraged Middle Eastern governments to strengthen their own guidelines, creating a more predictable environment that attracts substantial investment from both regional and international sources.

On the subject, Shafah Bar-Geffen, CEO and co-founder of Israel-based decentralized payments provider, the Coti Group, believes that Trump’s pro-crypto stance is likely to ease some of the uncertainty regarding regulations in the Middle East, bringing more clarity and, with it, adoption. He further added:

“America’s stance can often become a guiding precedent for global regulatory models and a more definitive strategy from the US could boost regulators in the Middle East in shaping their cryptocurrency regulations, which will translate into more participation as well as investment.”

In this regard, the response from major financial institutions has been quite positive, with Wall Street giants like Goldman Sachs and JPMorgan rapidly revising their cryptocurrency strategies to align with the new administration’s vision — a shift that seems to have reverberated throughout the Middle East, prompting regional banks and investment funds to develop more comprehensive digital asset strategies of their own.

Evidence of this accelerating adoption has already materialized in a big way, with Dubai’s DMCC Crypto Centre reporting a notable 300% increase in blockchain company registrations since Trump’s re-election. Meanwhile, Saudi Arabia has accelerated its central bank digital currency (CBDC) initiatives, launching pilot programs in partnership with American technology providers that align with the kingdom’s Vision 2030 goals of economic diversification.

The connections between the Trump administration and the Middle East’s crypto ambitions have been further strengthened through high-profile endorsements. For example, late last year President Trump’s middle-son Eric, spoke at the Bitcoin MENA conference in Abu Dhabi, explicitly acknowledging the UAE’s leadership in fostering a blockchain-friendly environment and highlighted potential areas for collaboration between American and Middle Eastern finance entities.

Building tomorrow’s financial oasis

With MENA members processing $338.7 billion in on-chain value between July 2023 and June 2024 alone, the region seems to have firmly established itself as a pivotal force in the digital asset arena. Particularly noteworthy is that 93% of these transactions were valued at $10,000 or more, indicating that institutional and professional investors have been key adoption drivers rather than retail speculation.

Looking ahead, MENA’s balanced approach to decentralized innovation suggests that the region is looking to build a sustainable infrastructure rather than simply riding the overarching market volatility, thus positioning it as a leader in the next phase of the global financial revolution (one where trad-fi and digital finance systems can converge seamlessly with one another).

Featured image via Shutterstock