Will Bitcoin Reach $200K? 10x Research Shares BTC Price Prediction for 2025

A significant price surge could be on the horizon for Bitcoin (BTC), with analysts projecting potential gains to $122,000 by February amid strong technical signals and market momentum.

More optimistic forecasts suggest that in the coming months of 2025, the price of BTC could approach $200,000, nearly doubling from its current levels.

How High Can Bitcoin Go? BTC Price Nears All-Time High

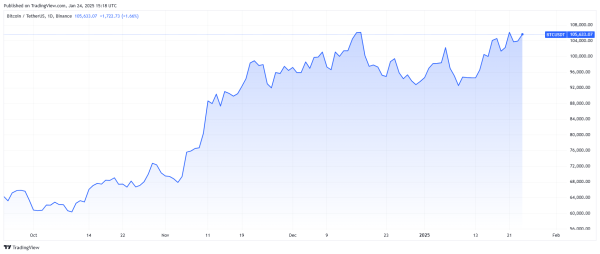

On Friday, January 24, 2025, Bitcoin’s price is trading above $105,000, just 3% below its all-time high (ATH) reached on January 20, when BTC briefly hit $109,356.

Why is Bitcoin going up today? Source: Tradingview.com

Why is Bitcoin going up today? Source: Tradingview.com

Although BTC’s price is currently stuck in a consolidation phase (established since November), ranging between resistance near $106,000 and support around $92,000, analysts’ projections for value changes in 2025 remain fairly optimistic.

Bitcoin Will Hit $122K Next Month – 10x Research

Markus Thielen, head of research at 10x Research, points to Bitcoin’s successful retest of its wedge breakout after bouncing from $98,937 to above $107,000. The cryptocurrency has demonstrated a pattern of advancing in $16,000 to $18,000 increments since the approval of spot Bitcoin ETFs.

“Gold and Bitcoin are entering a pivotal moment in the markets,” Thielen commented. “With gold rebounding near its all-time high and Bitcoin continuing to show bullish momentum, macroeconomic factors like easing inflation concerns, milder-than-expected tariffs, and dovish Fed commentary are driving optimism.”

Short-Term #Bitcoin Outlook: Our Target Revealed

👇1-10) #Gold and Bitcoin are entering a pivotal moment in the markets. With gold rebounding near its all-time high and Bitcoin continuing to show bullish momentum, macroeconomic factors like easing inflation concerns,… pic.twitter.com/QTQ8K0Sti0

— 10x Research (@10x_Research) January 21, 2025

The current market structure presents what analysts describe as a low-risk, high-reward entry opportunity, with strategic stop-losses possible around the $98,000 mark.

Paul Howard, Wincent

“Following what many see as a lack of crypto initiatives from the US administration in the first few days, Bitcoin price has been resilient and in line with the +/-10% move we anticipated 10-day period,” Pual Howard, director at Wincent, commented for Finance Magnates.

“Bystanders can take price direction from upcoming macroeconomic data and Lunar New Year which are expected to drive some downside risk before we see the asset class gathering momentum into Q2. At a recent dinner hosted by GFO-X, a straw poll indicated a median BTC price target of $150K for year-end.”

Several macroeconomic factors are contributing to the positive outlook:

- Easing inflation concerns

- Milder-than-expected tariffs

- Dovish Federal Reserve commentary

These elements, combined with recent CPI data, have strengthened the bullish case for both Bitcoin and gold, suggesting a potentially pivotal moment in the markets.

Bitcoin’s recent performance has showcased remarkable resilience, particularly in comparison to traditional stock markets. The cryptocurrency’s strong recovery following recent market events has reinforced confidence in its upward trajectory.

Will Bitcoin Reach $200K?

The bullish sentiment extends beyond the immediate price target. Market observers suggest that if the current pattern holds, Bitcoin could potentially trade significantly above the $122,000 level before establishing new support levels. This projection is further supported by Keith Alan, co-founder of Material Indicators, who identified a cup-and-handle pattern on Bitcoin’s weekly chart supporting the upward trajectory.

VanEck’s head of digital assets research, Matthew Sigel

In mid-December, VanEck unveiled its latest Bitcoin price prediction, estimating that the cryptocurrency could reach $180,000 by 2025. The firm’s analysis suggests the current crypto bull market will peak in the first quarter of 2025. Alongside Bitcoin’s projected surge, Ethereum is expected to exceed $6,000, while other notable cryptocurrencies like Solana and Sui are forecasted to climb to $500 and $10, respectively, highlighting the anticipated scope of the rally.

“Following this first peak, we anticipate a 30% retracement in BTC, with altcoins facing sharper declines of up to 60% as the market consolidates during the summer,” VanEck’s Matthew Sigel forecasted. “However, a recovery is likely in the fall, with major tokens regaining momentum and reclaiming previous all-time highs by the end of the year.”

An even higher forecast was presented over the past month by Standard Chartered, which claims that Bitcoin will reach $200K by the end of 2025.

„The dominance of institutional inflows to ETFs is likely to support BTC and ETH performance; we see their prices reaching the $200,000 and $10,000 levels by end-2025, respectively,” commented Geoffrey Kendrick from Standard Chartered.

Bitcoin Price Prediction 2025, FAQ

Bitcoin could potentially reach $200,000 by the end of 2025, according to optimistic market projections. Analysts from institutions like Standard Chartered suggest institutional inflows into Bitcoin ETFs will drive the price upward. Other estimates, such as VanEck’s, foresee a peak of $180,000 in the first quarter of 2025, with subsequent corrections and a potential recovery later in the year. However, reaching $200,000 would require a continuation of bullish momentum, supported by favorable macroeconomic factors, strong market demand, and sustained investor confidence.

Can Bitcoin reach $250,000?

Although projections for Bitcoin reaching $250,000 remain speculative, they hinge on the cryptocurrency maintaining significant market momentum and broader adoption. Standard Chartered’s $200,000 forecast suggests such milestones are not entirely implausible but depend on institutional support, regulatory clarity, and macroeconomic conditions. While Bitcoin’s recent performance has shown resilience, surpassing $250,000 would likely require a new wave of adoption and investment beyond what analysts currently predict for 2025.

How high could Bitcoin realistically go?

Bitcoin’s price is influenced by market dynamics, macroeconomic conditions, and technological adoption. Currently trading near its all-time high of $109,356, realistic estimates for 2025 suggest a range of $122,000 to $200,000. Predictions exceeding this range would depend on a confluence of factors, including widespread adoption, institutional inflows, and positive regulatory developments. While $250,000 or higher is conceivable in the long term, it would require a paradigm shift in market dynamics.

What if you put $1,000 in Bitcoin 5 years ago?

If you had invested $1,000 in Bitcoin five years ago (January 2020), when Bitcoin was trading around $8,000, your investment would have grown substantially. With Bitcoin’s current price exceeding $105,000, your $1,000 investment would now be worth approximately $13,125, reflecting a return of over 1,200%. This calculation demonstrates Bitcoin’s historical growth but also underscores the volatility and risk associated with cryptocurrency investments.