XRP exchange reserves rocket to 1-month high

XRP exchange reserves rocket to 1-month high

![]() Cryptocurrency May 12, 2025 Share

Cryptocurrency May 12, 2025 Share

Summary

⚈ XRP exchange reserves surged 4.11% to a 1-month high of 2.84 billion.

⚈ Ripple’s SEC settlement news boosted XRP’s price from $2.14 to $2.34.

⚈Whales moving XRP to exchanges hints at potential selling pressure ahead.

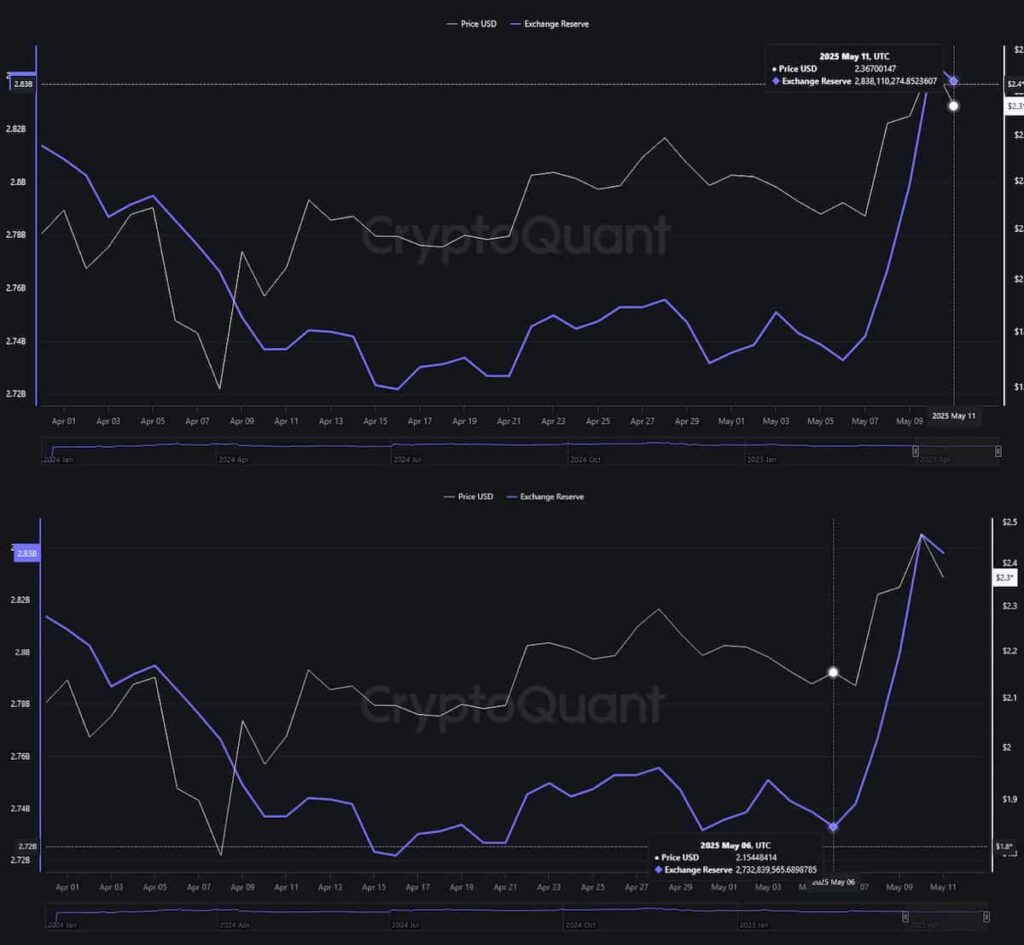

XRP exchange reserves reached a 1-month high on May 10, when some 2,845,253,166 tokens were being held on exchanges.

This represents a noticeable surge of 4.11% since May 6, when the exchange reserves totalled 2,732,839,565 XRP, per data retrieved by Finbold from on-chain analytics platform CryptoQuant.

XRP exchange reserves chart. Source: CryptoQuant

XRP exchange reserves chart. Source: CryptoQuant

By press time on May 12, XRP exchange reserves had diminished slightly, down to 2,838,110,274.

Elevated XRP exchange reserves could hint at post-rally profit taking

In the same timeframe that saw a 4.11% increase in XRP exchange reserves, the price of XRP increased from $2.14 to $2.34, following a key development in the Ripple v. SEC case on May 8, when the Securities and Exchange Commission (SEC) filed a settlement agreement letter.

On the back of such a major bullish development, which occurred in tandem with a crypto market-wide surge, XRP is expected to continue on its upward trajectory — but increased exchange reserves often signal the emergence of greater selling pressure.

In addition, whales have started moving large holdings onto exchanges — possibly signalling that a large XRP dump is coming.

The token was changing hands at $2.41 at the time of writing, having marked a 10.42% gain in the last 7 days.

XRP price 1-week chart. Source: Finbold

XRP price 1-week chart. Source: Finbold

Range bound trading remains a distinct possibility for XRP in the near term, particularly as open interest remains at low levels on a year-to-date (YTD) basis. Going forward, decisive bounces of the $2.40 mark could establish a line of support — in contrast, the rally currently doesn’t seem to have enough steam to breach the $2.50 mark.

With that being said, the SEC’s XRP exchange-traded fund (ETF) decision, which will be delivered in mid-July, could serve as a catalyst for a more far-reaching bull run.

Featured image via Shutterstock