XRP price prediction as number of addresses hits 7 million record high

XRP price prediction as number of addresses hits 7 million record high

![]() Cryptocurrency Mar 15, 2025 Share

Cryptocurrency Mar 15, 2025 Share

XRP is experiencing a surge in the number of addresses, a key on-chain catalyst that could push its price above the $3 resistance.

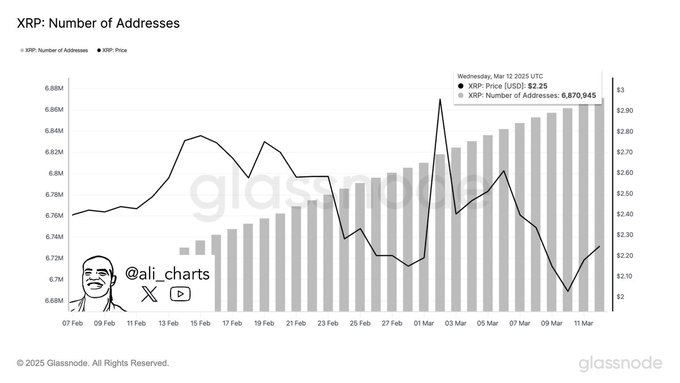

Specifically, as of March 12, 2025, the number of XRP addresses reached a record 6,870,945, according to data from cryptocurrency analytics platform Glassnode, as shared by Ali Martinez on March 14.

Since early February, XRP addresses have grown steadily, with the sharpest increase occurring between late last month and early March, coinciding with the asset’s heightened price volatility.

Picks for you

Commodity strategist warns Bitcoin could drop to $10,000 6 hours ago Expert identifies Solana's path to $4,000 9 hours ago 2 cryptocurrencies to reach a $1 billion market cap in March 21 hours ago Is Elon Musk now killing Dogecoin (DOGE)? 1 day ago  XRP number of addresses. Source: Glassnode/ Ali_charts

XRP number of addresses. Source: Glassnode/ Ali_charts

Despite network expansion, XRP’s price has fluctuated, aligning with market sentiment, and maintained support above the crucial $2 level. The increase in new addresses aligns with XRP’s recent attempts to reclaim the $3 mark, suggesting growing investor engagement, a potential bullish signal.

AI predicts XRP price for end of 2025

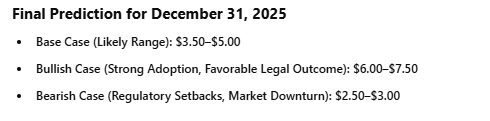

To assess XRP’s price trajectory in line with the new onchain milestone, Finbold consulted OpenAI’s ChatGPT-4o. The AI model predicted that XRP could trade between $3.50 and $5 by year-end, with a potential breakout above $6 under favorable conditions.

ChatGPT noted that rising active addresses historically correlate with price growth. A strong crypto market rally, particularly in Bitcoin (BTC), or a favorable outcome in Ripple’s and Securities Exchnage Commission’s (SEC) case could further boost XRP’s price.

The AI platform noted that key resistance at $3 and $3.80 must be overcome for sustained gains. However, regulatory setbacks or a broader market downturn could cap prices between $2.50 and $3.

XRP AI price prediction. Source: ChatGPT

XRP AI price prediction. Source: ChatGPT

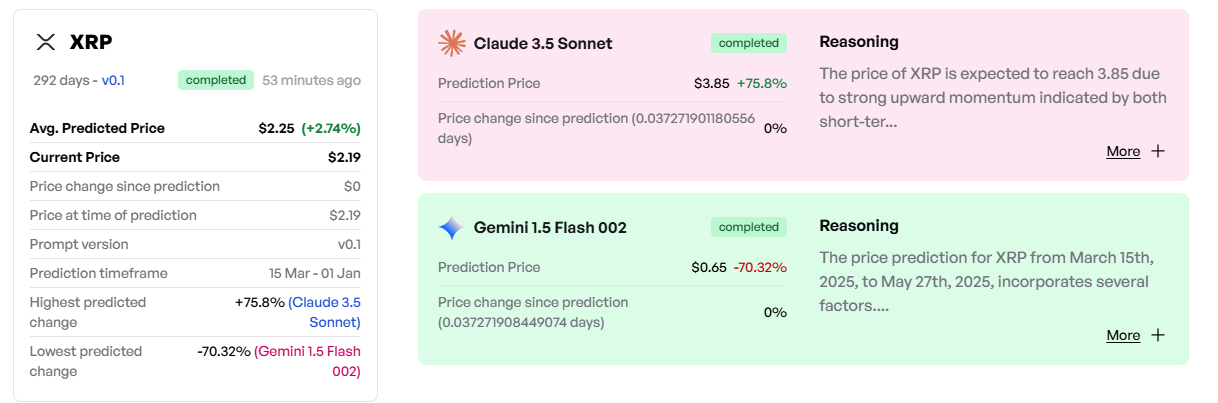

On the other hand, Finbold’s in-house AI tool, which leverages several models, projected an average price of $2.25 for XRP by the end of 2025.

For instance, Claude 3.5 Sonnet forecasted a surge to $3.85 by December 31, 2025, citing bullish momentum, technical indicators, and expected interest rate cuts boosting institutional adoption.

Conversely, Gemini 1.5 Flash 002 presented a bearish scenario, predicting a decline to $0.65 due to economic uncertainty and market volatility.

Finbold AI XRP price prediction. Source: Finbold

Finbold AI XRP price prediction. Source: Finbold

XRP technical outlook

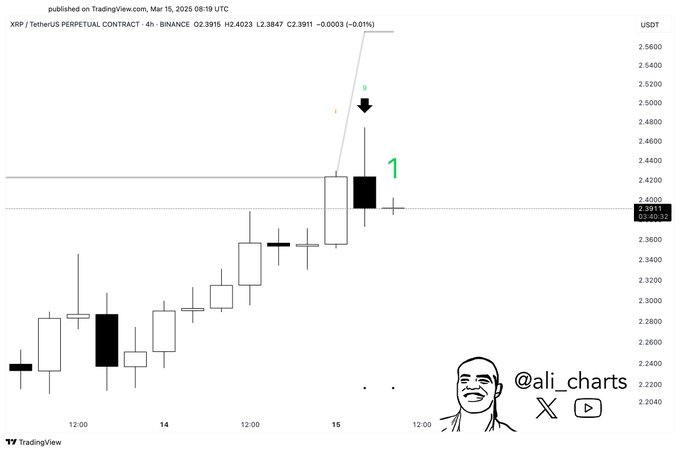

When looking at the technical aspect in the short term, Martinez cautioned that XRP may undergo a price correction, potentially presenting a buying opportunity.

On March 15, he noted that XRP’s TD Sequential indicator flashed a sell signal on the four-hour chart, suggesting a temporary pullback before a potential rebound.

XRP price analysis chart. Source: TradingView/Ali_charts

XRP price analysis chart. Source: TradingView/Ali_charts

Based on this outlook, XRP’s key support levels to watch are $2.30 and $2.20, where buyers may step in. Despite this, XRP remains in an uptrend, with traders eyeing a buy-the-dip opportunity.

Adding to potential volatility, Ripple is set to release $465 million worth of XRP in March from its reserve, a transaction that could introduce news price swings.

Elsewhere, pseudonymous crypto analyst Egrag Crypto outlined three potential scenarios for XRP. The expert noted that if the token closes above $2.83, it could signal bullish strength, potentially pushing toward $4.20.

XRP price analysis chart. Source: TradingView

XRP price analysis chart. Source: TradingView

Holding above key resistance levels at $2.40, $2.97, and $3.07 could further reinforce an uptrend. However, the analyst noted that a drop below these levels might trigger a decline toward the Fib 0.786 level, possibly forming a bear trap, especially if Bitcoin retests $70,000.

Egrag Crypto sees a deeper drop as a generational buying opportunity rather than a bear market signal.

Overall, XRP is following a short-term bullish trajectory, aligning with the broader cryptocurrency market recovery. At the time of reporting, the token was trading at $2.43, up over 4% in the last 24 hours and nearly 3% for the week.

In the long term, XRP’s potential hinges on key fundamentals, including a possible resolution of Ripple’s SEC case. Reports suggest the regulator might seek to conclude the matter soon, especially given the current crypto-friendly regulatory environment.

Featured image via Shutterstock