XRP wipes out over $10 billion in a week

XRP wipes out over $10 billion in a week

![]() Cryptocurrency Jun 18, 2025 Share

Cryptocurrency Jun 18, 2025 Share

In the span of just one week, XRP’s market capitalization has fallen from $136.73 billion to $125.78 billion, erasing nearly $11 billion in value.

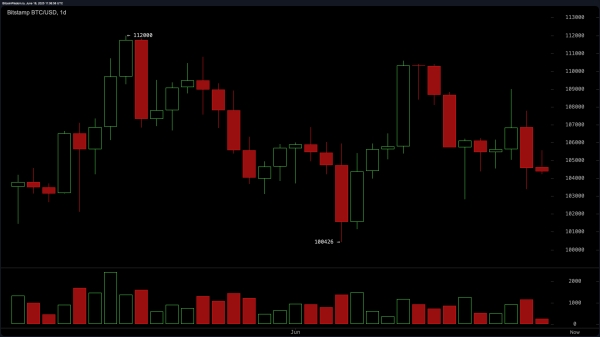

XRP 7-day market cap. Source: CoinMarketCap

XRP 7-day market cap. Source: CoinMarketCap

The token is now trading at $2.13, down 7.9% over the last 7 days and more than 7.3% month-over-month, according to data from CoinMarketCap.

In particular, the price decline marks the second consecutive daily loss, continuing a downtrend that has deepened despite otherwise bullish headlines.

Zooming in, 24-hour trading volume has cratered by 39%, with activity dropping to just $3.21 billion, signaling weakening momentum and risk-off behavior from both retail and institutional traders.

This cooling comes at a curious time.

Spot XRP ETF

Earlier this week, Purpose Investments received final approval from Canadian regulators to launch the first spot XRP ETF, with trading beginning June 18 on the Toronto Stock Exchange under the ticker XRPP.

June 18th. TSX. Get ready.

Announcing the Purpose XRP ETF, offering regulated, direct exposure to spot #XRP, the native token powering fast, low-cost cross-border payments ⚡️

🔗 Fund page: https://t.co/CfCEdbOUEp

🔗 Press release: https://t.co/8v1FPkXSdU… pic.twitter.com/uzNgZyRpC3— Purpose Investments (@PurposeInvest) June 16, 2025

The listing represents a major milestone for XRP, granting Canadian investors regulated, brokerage-level access to the token via retirement accounts and institutional platforms. And yet, the market barely reacted.

Rather than rally on the news, XRP slipped further. That divergence suggests either the ETF was priced in, or broader sentiment is still being held hostage by unresolved legal uncertainty in the United States.

The Ripple v. SEC case, originally projected to wrap up this quarter, has now been delayed until at least August 2025, after Judge Torres approved a request for extended remedy briefing. While the delay buys Ripple time, it also prolongs the cloud hanging over U.S.-based institutions waiting for legal clarity before onboarding XRP at scale.

This legal limbo could help explain why even a landmark ETF approval in North America failed to ignite price action.

Still, technicals show the potential for sudden movement. As reported in our earlier coverage, XRP’s liquidation map reveals over $500 million in leveraged short positions stacked between $2.20 and $2.40. If bullish momentum returns and forces a breakout above that band, a cascading short squeeze could follow.

But for now, XRP remains in the red. Legal clarity is months away. And ETF excitement, at least in this cycle, isn’t translating into upside.

Featured image via Shutterstock