‘XRP’s 5-year pattern builds path to $6.50’

‘XRP’s 5-year pattern builds path to $6.50’

![]() Cryptocurrency Mar 30, 2025 Share

Cryptocurrency Mar 30, 2025 Share

As XRP consolidates above $2 following a massive capital outflow on the weekly timeframe, the asset’s technical indicators suggest that historical patterns hint at a new record high.

In this case, XRP is likely on the verge of a major breakout, following a pattern that closely resembles its 2020–2021 rally while trading in a five-year channel-up formation, according to analysis by Investing Scope, an independent signals and training provider, in a TradingView post on March 28.

XRP price analysis chart. Source: TradingView

XRP price analysis chart. Source: TradingView

If history is any indication, XRP could surge toward $6.50, potentially by October 2025, a period that will coincide with the Securities and Exchange Commission’s (SEC) decision on several XRP spot exchange-traded fund (ETF) applications.

Picks for you

Bear market is within 'striking distance' in a few weeks, warns strategist 3 hours ago AI sets gold price for April 30, 2025 6 hours ago

The analyst backed this outlook by pointing to several key technical indicators. For instance, XRP remains above its one-week moving average (MA) of 50, which has historically supported major uptrends.

The Relative Strength Index (RSI) at 53 suggests a neutral stance but mirrors the structure seen before XRP’s rally in 2020. Meanwhile, the Average Directional Index (ADX) at 41.023 indicates a strong trend, and the Moving Average Convergence Divergence (MACD) at 0.310 remains in bullish territory, hinting at further upside potential.

This setup is compelling because it resembles the March 2020 to April 2021 cycle, when XRP surged 1,648%. If history repeats, XRP could be on the verge of another parabolic move toward $6.50, aligning with the upper resistance of its long-term channel.

Currently, the cryptocurrency is consolidating much like it did in March 2021, just before its last breakout. Investing Scope noted that the bullish thesis remains intact as long as XRP stays above the 1W MA50. If the pattern holds, the final leg of this cycle could deliver a major rally over the next year.

XRP price grim short-term outlook

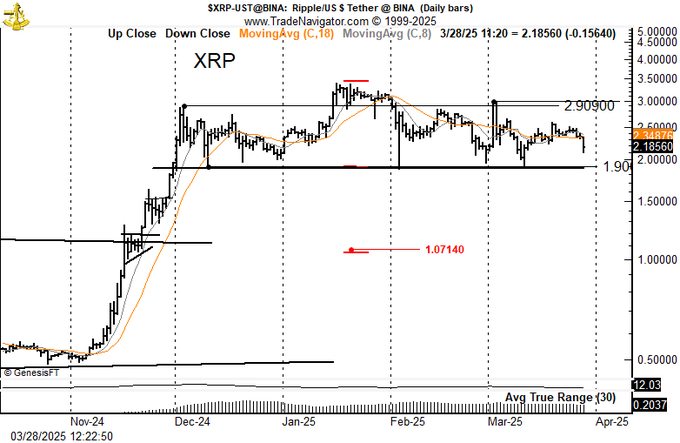

Although the long-term technical outlook for XRP looks bullish, the near-term sentiment paints a grim picture for the asset. For instance, veteran trading expert Peter Brandt stated that XRP is staring at a possible crash toward the $1 mark.

He observed that XRP is forming a complex Head & Shoulders pattern, a bearish reversal signal whose downside lies at $1.07 unless bulls reclaim $3. This formation indicates weakening momentum for XRP as bears seemingly overpower bulls.

XRP price analysis chart. Source: Peter Brandt

XRP price analysis chart. Source: Peter Brandt

Amid the current volatility, XRP might see extended losses in the short term if whale activity is anything to go by. In this line, data shared by prominent on-chain analyst Ali Martinez in an X post on March 30 stated that whales offloaded 1.12 billion XRP in 48 hours.

XRP whale transaction chart. Source: Santiment/Ali_charts

XRP whale transaction chart. Source: Santiment/Ali_charts

This move raises concerns about the cryptocurrency’s short-term outlook, as large-scale sell-offs often signal profit-taking or a shift in sentiment among major holders, potentially leading to increased volatility.

Indeed, XRP is trading in line with general market momentum, with the assets witnessing notable capital outflows despite being backed by bullish sentiments. For XRP, the token is still struggling for stability despite receiving a major regulatory boost after the SEC took steps to drop the Ripple case entirely.

XRP price analysis

By press time, XRP was trading at $2.14, having gained about 1% in the last 24 hours. On the weekly chart, the asset is down 11%.

XRP seven-day price chart. Source: Finbold

XRP seven-day price chart. Source: Finbold

As things stand, for XRP to maintain any hope of a bullish push, the asset needs to find extended stability above the $2 support in anticipation of a general cryptocurrency resurgence.

Featured image via Shutterstock